|

A user's Yu'ebao account shown on his mobile phone. Yu'ebao offers around 6 percent annualized return, much higher than the banks'0.36 percent interest rate on demand deposits. [Photo/Xinhua] |

Big four State financial players battle upstart for nation's massive base of deposits

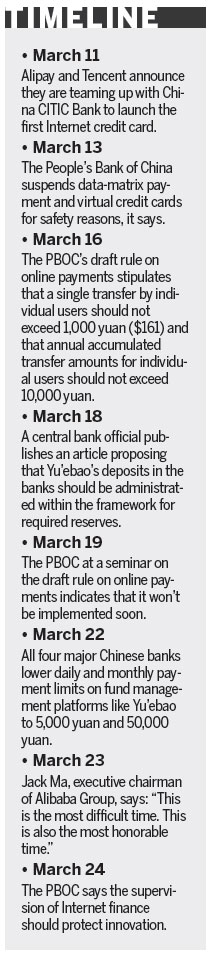

That all four major State-owned banks in China had cut their daily transfer limits to Yu'ebao, a fund management platform of Chinese e-commerce giant Alibaba Group Holding Ltd, to 5,000 yuan ($820) from the previous 50,000 yuan by last weekend, raises a vexing question: What law gives banks the power to restrict customers' rights to manage their own wealth?

Yu'ebao offers around a 6 percent annualized return, much higher than the banks' 0.36 percent interest rate on demand deposits. Since its launch nine months ago, Yu'ebao has pooled about 500 billion yuan in a cash balance from 81 million users of Alibaba's Alipay, a third-party payment system like Paypal.

On Monday, the People's Bank of China, the nation's central bank, made a new rule that the banks should reduce interest payments from negotiated-term deposits if depositors withdraw money earlier than the negotiated term. The timing of this move is believed to have targeted Yu'ebao.

The fund management platform put 90 percent of the money it holds into bank negotiated-term deposits, which yield a much higher return than direct deposits. The remainder is invested in interbank markets.

Wang Dengfeng, Yu'ebao's fund manger, responded to the central bank's new rule. He said: "More than 70 percent of our deposits are less than one month. The new rule will not have a big impact on our liquidity."

Unlike banks, to compete for customers, Yu'ebao is paying most of its margin to its customers, at least in the early stages of its development.

Neither Alipay nor Yu'ebao has the legal certification of banks. Their third-party payment and service systems are actually regarded as replacements for the payment and demand deposits of banks by many online shoppers.

A total of 104.4 trillion yuan was deposited in Chinese financial institutions at the end of 2013. Yu'ebao accounts for only 0.48 percent of that total.

It is its remarkable growth, flexibility and innovation that makes bank managers uneasy because their interest rates are controlled by the government. The managers consider the competition with Yu'ebao to be on an unfair footing.

The dilemma leaves the financial industry administrations with three choices. First, grant Yu'ebao the qualifications to be a bank and include it in the current banking and supervisory system. Second, lift interest rate controls on banks. Third, set strict limits on the amount of money Yu'ebao can transfer.

Given the slow pace of reform in the banking system, the first choice is no different to killing innovation using the Internet finance. The speed of Yu'ebao's growth leaves no time for the conditions to mature for the second choice to be acceptable. The third option is therefore the only acceptable choice regarding the vested interests of banks, despite the harm it does to Yu'ebao.

The four banks' recent unanimous action to limit the daily and monthly transfers of Yu'ebao, and the central bank's acquiescence over their action, leaves the market no room to respect customers' rights or allow for the innovation of Internet finance.

To quell the market's discontent, the central bank said on Monday, Internet finance should serve the real economy and customers - paradoxically, something the banks badly need to do. "There should be moderate supervision of online finance, leaving enough space for its development," the central bank's statement said.

|

|

|