There is much debate in Beijing about the timing of a reserve requirement ratio (RRR) cut. Most indicators suggest that if history is any guide, a RRR cut should have already happened, said a research report of Standard Chartered Bank (HK) Ltd. Excerpt:

Is that the rumble of the Godzilla of monetary policy easing we hear? Maybe. A debate is raging in Beijing about whether to cut commercial banks' reserve requirement ratio (RRR). Today, we run through the numbers and show that if history is any guide, a RRR cut should have already happened.

The problem is that history is not a great guide. Faced with slower growth, the Li Keqiang government is clearly reacting differently than the previous administration. Chinese President Xi Jinping says that China should get used to a "new normal" economic situation. Both should be congratulated for holding the line and attempting to push through difficult reforms. However, while deleveraging cannot be achieved with super-loose monetary policy, it also cannot be attained with high real interest rates and low (and slowing) nominal GDP growth. We believe the time is coming when a RRR cut and broader-based easing will be needed to stabilize growth.

Commentators, including a former People's Bank of China (PBOC) deputy governor, have spoken out in recent days against the need for a RRR cut, and looser monetary policy generally. In addition, PBOC governor Zhou Xiaochuan said recently that the economy does not need a "large-scale stimulus"; we guess that he might view a RRR cut as such a move.

Those opposing a cut believe that the economy, while slowing, does not have a jobs problem, or that there are systemic risks in the financial system. So why cut? They are also concerned that a RRR cut would signal that Beijing is relying again on easy monetary policy and putting off difficult structural reforms.

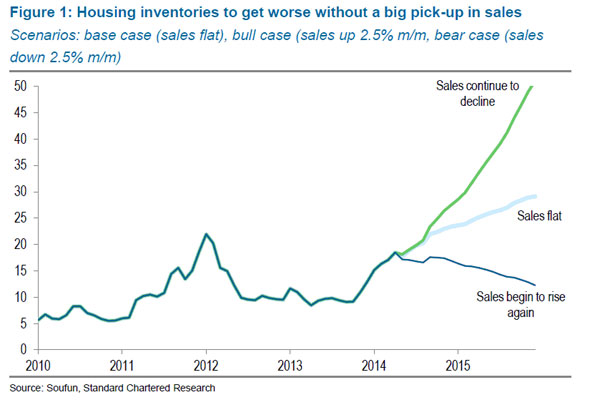

Others advocate and/or expect a RRR cut in Q2 or early Q3; we fall into this camp. We have a negative short-term view on growth. Credit growth is slowing and housing is heading into what could be a messy correction. Figure 1 shows what is likely to happen to housing inventories in China's top 40 cities if sales remain at today's levels. The situation in smaller cities could be worse – we have little data on this.

In addition to creating more room on banks' balance sheets to lend, we believe a RRR cut will soon be needed to shore up onshore confidence. In order to be effective, a cut would have to be coordinated with other measures, such as more relaxed enforcement of banks' maximum loan-deposit ratios and lower mortgage rates and down-payment ratios.

Zhu Baoliang, a senior economist at the State Information Centre (which operates under the National Development and Reform Commission), called last week for more monetary policy flexibility and a RRR cut.

We now take a look at what triggered Beijing to cut the RRR in the two cutting cycles in recent memory. Starting in September 2008, the RRR was reduced by a total of 250bps. This was in response to the global financial crisis and a collapse in external demand – a clear emergency. The RRR was also cut in December 2011 and February 2012, by a total of 100bps. This move was more similar to today's situation, coinciding with a slowdown in industrial activity and housing. We have assembled several key economic indicators, including industrial value-added growth, electricity growth and interbank liquidity,to show what was happening when the RRR was cut in 2008 and 2011.

The issue for us is that the Li government's way of reacting to slower growth is different from its predecessor's. Without such a shift in the policy stance, our indicators suggest that a RRR cut should have already happened. Quite when this government will react is not easily predictable.

The author is head of Greater China Research at Standard Chartered Bank. The views do not necessarily reflect those of China Daily.