Increased cross-border lending may pose long-term concerns, bank says

Indicators are sending worrisome signals on increased cross-border lending to China's enterprises, a large portion of which is short-term and may increase liquidity tensions in the financial markets, according to reports from the Bank for International Settlements.

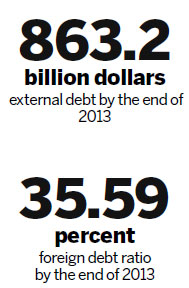

By the end of last year, China's external debt totaled $863.2 billion, up 17 percent year-on-year, according to the State Administration of Foreign Exchange.

While global combined cross-border lending had shrunk for seven consecutive quarters, claims on China grew 9 percent quarter-on-quarter in the fourth quarter of 2013, reaching $81 billion, according to the BIS Quarterly Review on international banking and financial market developments, which was released in June.

Consolidated banking statistics indicate that the recent robust growth in international lending to China was fulfilled primarily by short-term lending, the report said.

"The share of international claims on China with a remaining maturity of less than one year rose from 56 percent at the end of 2007 to 76 percent at end of 2010, and 79 percent at end of 2013," the report said.

The latest annual report from BIS, which was released on Sunday, said corporations in China face risks amid new funding sources. Market financing can be cheap and plentiful when conditions are good but can evaporate at the first sign of problems, the annual report said.

"This could also have residual effects on domestic financial institutions, which have relied on the domestic corporate sector for an important part of their funding," the report said.

The vast majority of the private external debt of emerging markets, including China, remains in foreign currency, thus exposing borrowers to currency risks.

Private corporations have turned to overseas funding channels when domestic funding sources, such as the property market, have dried up.

|

|

| Top 10 richest banks in the world | Top 10 most attractive FDI destinations in the world |