|

|

|

A worker shovels iron ore at Qingdao Port, Shandong province. Ore with 62 percent content at Qingdao fell to $90.07 a metric ton on Monday. [Photo/China Daily] |

Iron ore prices are at risk of falling to their lowest level since 2009 as increased supplies from Australia and Brazil boost a global surplus and prompt the closure of some higher-cost Chinese suppliers.

Ore with 62 percent content at Qingdao fell 0.3 percent to $90.07 a metric ton on Monday, according to data from Metal Bulletin Ltd. That is near this year's low of $89.48 on June 16, which was the lowest price since September 2012, when it bottomed out at $88.08. A price of less than $88.08 would be the lowest seen since October 2009.

The commodity may retreat to $80 a ton this year, according to Helen Lau, an analyst at UOB Kay Hian Ltd in Hong Kong.

Prices have fallen 33 percent this year as mining companies from BHP Billiton Ltd to Rio Tinto Group increased output, pushing the global seaborne market into a glut.

Major producers in Australia, which have average costs of about $40 to $50 a ton, are continuing to increase supplies even with prices near their lowest level in five years, Australia & New Zealand Banking Group Ltd said in a report on Tuesday.

"There's still room for iron ore prices to go down," Lau said. "There will be a lot of cheap seaborne supplies to replace Chinese market share. They will drive the price down lower."

Global seaborne output will exceed demand by 72 million tons this year and 175 million tons in 2015, Goldman Sachs Group Inc estimates. China's economy, which accounts for about 67 percent of seaborne demand, will probably grow this year at the weakest pace since 1990, according to a Bloomberg survey.

"With supplies ramping up, and China's property market looking to be in the relatively early stages of adjusting to a supply glut, it's certainly a scenario where buyers may now be in a position to delay purchases in the spot market," Ric Spooner, chief strategist at CMC Markets in Sydney, said. "That could easily see prices drift lower."

Fortescue Metals Group, Australia's third-biggest producer, said last week prices are poised for gains as its reported full-year profit rose to a record on higher output. Vale SA, the world's biggest producer, based in Rio de Janeiro, forecast on July 31 that prices would rebound as supply growth slows and higher-cost mines close.

Rio Tinto plans to boost output 11 percent this year to 295 million tons, and estimates output of more than 330 million tons starting next year. BHP, the third-largest supplier, said that production from its Western Australian mines will increase to about 245 million tons in the 12 months ending June 30, 2015.

"The major iron ore players are determined to 'crowd out' smaller, higher-cost producers," said Gavin Wendt, founder and senior resource analyst at Sydney-based Mine Life Pty Ltd. "Rising production will also, to some degree, offset falling prices for these companies, as their margins remain strong."

|

|

|

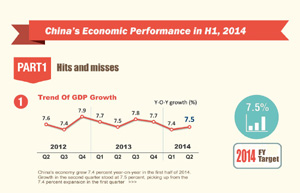

| Infographic: China's economic performance in H1, 2014 | China's economy to grow 7.5% in 2014: IMF |