Agricultural Bank of China Ltd posted an increase in bad loans during the first half of this year while the growth in net profit slowed amid China's economic downturn.

As the nation's third-largest lender by market value, the bank's outstanding non-performing loans rose to 97.5 billion yuan ($15.8 billion) as of June 30 from 92 billion yuan on Dec 31, 2013. Its NPL ratio increased from 1.22 percent to 1.24 percent during the same period, bank officials told reporters at a news conference in Beijing on Tuesday.

Its net profit in the first half rose by 12.6 percent year-on-year, falling from a 14.7 percent growth a year earlier. Like other domestic lenders, Agricultural Bank is facing shrinking net interest margin during the process of China's liberalization of interest rates.

Zhang Yun, the bank's president, said: "Bad loans of the Chinese banking sector have been on the rise in general due to combined effects of economic slowdown and restructuring. This is unavoidable if we take the economic cycle into consideration. Although Agricultural Bank saw an increase in its non-performing loans and NPL ratio, the growth rates were lower than those of many other domestic banks."

The bank wrote off bad loans worth 6.9 billion yuan and sold bad loans worth 8.3 billion yuan in the first half. It will make further arrangements to improve the asset quality during the second half, said Tian Jimin, deputy director of the risk management department of Agricultural Bank.

"Asset quality of a bank is closely related to the economic environment. With China's economy starting to pick up gradually, our bank's asset quality will also rise steadily," Tian said.

Agricultural Bank is joining rivals such as Industrial & Commercial Bank of China Ltd and Bank of China Ltd in planning sales of subordinated securities to replenish their Tier-1 capital to meet tougher capital requirements as profit growth slows. The lender calls the securities preferred shares.

Tier-1 capital ratio of Agricultural Bank, a core measure of the bank's capital adequacy and financial strength, fell to 8.65 percent on June 30 from 9.25 percent on Dec 31.

Under China's implementation of Basel III guidelines, systemically important banks need a minimum Tier 1 capital ratio of 9.5 percent, with total buffers of 11.5 percent, before the end of 2018.

Agricultural Bank completed issuing 30 billion yuan of 10-year Tier-2 securities at a fixed interest rate of 5.8 percent on Aug 18. Xu Duo, the bank's office administrator of board of directors, said the bank will issue preferred shares worth no more than 40 billion yuan this year, and its capital adequacy ratio will increase by 0.4 percentage point.

The lender's shares declined 0.3 percent to close at HK$3.65 (47 cents) in Hong Kong on Tuesday before the earnings announcement. The shares have fallen 0.8 percent this year in Shanghai and 4.2 percent in Hong Kong on rising default risk, heightened competition for deposits and weaker credit demand.

|

|

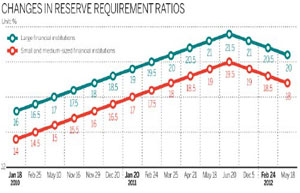

| Nation's big five banks plan bond sales in order to boost their capital | More lenders make RRR cuts |