Chinese banks face a "major risk" from rising nonperforming loans in the second half of the year as the economy slows, PricewaterhouseCoopers said on Thursday.

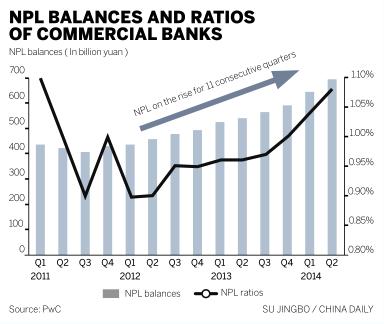

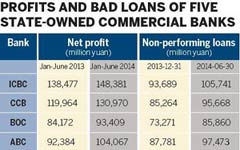

NPLs at the country's top 10 listed banks stood at 520 billion yuan ($84 billion) as of June 30, up 71 billion yuan from Dec 31, 2013. That was almost as much as the rise for all of last year, which was 73 billion yuan, according to PwC.

The overall NPL ratio rose by 7 basis points to 1.06 percent during the first half.

"The NPL balance and NPL ratio rose in tandem, reflecting a significant downward trend in the quality of credit assets," said Raymond Yung, head of PwC's China financial services unit.

|

|

|

|

Decelerating GDP growth and economic restructuring are the major causes of the worsening debt picture, said Yung.

Economic figures for August painted a gloomy picture. Industrial output grew at the slowest pace since the 2008 global financial crisis, and growth in fixed-asset investment, a driver of economic activity, slowed to a 14-year low of 16.5 percent in the first eight months of the year.

"We expect the NPL ratio to climb further in the second half, and the figure will be close to the overdue ratio," Yung said.

The NPLs for the top 10 banks were concentrated in the manufacturing, wholesale and retail sectors, PwC said.

Although the property market has been weakening since the beginning of the year, NPLs in this sector dropped compared with the same period last year.

"As most banks started to impose strict risk controls over mortgages three to four years ago, the loan assets in this sector are of good quality. Meanwhile, a number of property developers have raised financing from trusts or other private channels instead of bank loans," said Richard Zhu, financial service partner at PwC China.

In terms of geography, the Yangtze River Delta had the highest NPL balance at mid-year, PwC said. The balance as of June 30 was up 7.71 percent from Dec 31 to 109.4 billion yuan.

The figure was much higher than that for the Pearl River Delta region, which was second, or the Bohai Rim region in northern China, which ranked third.

In addition, NPLs in the Pearl River Delta grew at the fastest pace among regions during the first half, by 30.7 percent, which is an "alarming trend", PwC said.

Given the heavy concentration of private enterprises in the Yangtze and Pearl deltas, these regions "are more vulnerable to the economic slowdown", said Zhu.