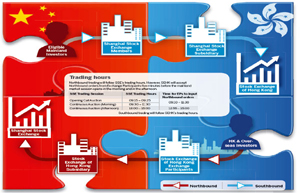

China's plan to give foreign investors unprecedented access to mainland equities through the Shanghai-Hong Kong exchange link has JP Morgan Chase & Co pointing to an unlikely beneficiary - the bond market.

While fixed-income securities are excluded, the link will provide another route to buy Shanghai shares for money managers who already have approval to invest in Chinese stocks and bonds through the Qualified Foreign Institutional Investor program. That frees up some of their $64 billion quota to be deployed in the debt market, according to JPMorgan.

Investors will be "switching their QFII investments," said Adrian Mowat, the chief Asian and emerging markets equity strategist at JPMorgan in Hong Kong. "You can then use it for things in the fixed-income market."

Nikko Asset Management Co and Principal Global Investors say they are considering such a shift after the bourse link starts on Nov 17, giving anyone with a Hong Kong brokerage account access to Shanghai shares. While approved QFII quotas are equivalent to less than 2 percent of China's $4.64 trillion bond market, Deutsche Bank AG said that debt issued by railway companies and China Development Bank Corp may attract funds as investors adjust their holdings.

Global holdings of China's onshore bonds climbed 59 percent this year as the central bank loosened monetary policy to counter an economic slowdown. The nation's sovereign bonds handed investors an average return of 11.3 percent, trailing only India's performance among Asian markets tracked by Bloomberg World Bond Indexes.

China's benchmark 10-year yield of 3.56 percent compares with 2.37 percent in the United States, 0.51 percent in Japan and 0.81 percent in Germany. The yuan is the only one of 31 major currencies to have strengthened against the dollar since June.

Nikko Asset, which oversees $168 billion, may free up some of its $450 million QFII quota for investments that are not possible under the stock link, said Eng Teck Tan, a Singapore-based senior fund manager for equities.

Binay Chandgothia, who helps oversee more than $30 billion as a managing director and portfolio manager at Principal Global Investors in Hong Kong, said he faces similar considerations with respect to the firm's $150 million quota.

The new stock link will allow investors with brokerage accounts in Hong Kong to buy a net 13 billion yuan ($2.1 billion) of Shanghai-listed shares per day. Railroad bonds and debt issued by CDB may appeal to foreign investors with unused QFII quota, Yuliang Chang, chief China equity strategist at Deutsche Bank, wrote in a note on Monday.

The 10-year bonds of companies under the Ministry of Railways yielded 4.55 percent on Wednesday, about a percentage point more than sovereign debt, ChinaBond data show. Notes of similar maturity from the three policy lenders - China Development Bank, Agricultural Development Bank of China and Export-Import Bank of China - yielded 3.99 percent.

Overseas investors held 205.5 billion yuan of Chinese government securities and 214.2 billion yuan of those issued by the policy banks at the end of last month, data from China Central Depository & Clearing Co show.

"Clients can assess how strategically they will utilize QFII after Stock Connect is formally launched," Hugo Leung, deputy chief executive of BNP Paribas Securities (Asia) Ltd, said on Wednesday in an interview in Hong Kong. "They see Stock Connect as an extra avenue to get onshore."

Clients can assess how strategically they will utilize QFII after Stock Connect is formally launched. They see Stock Connect as an extra avenue to get onshore."

|

|

| Consumer shares to gain from HK link | Preferential tax policy in pipeline for Stock Connect program |