People's Bank of China cut benchmark rates by another 25 basis points, bringing the one-year benchmark lending rate to 5.35 percent and the one-year benchmark deposit rate to 2.5 percent, effective from March 1. Meanwhile, as another move towards interest rate liberalization, PBOC has lifted China's deposit rate ceiling further from 1.2 times of benchmark to 1.3 times.

The move came as no surprise following the particularly weak prints of January inflation, and another soft reading expected for February. Both CPI and PPI slipped to a 5-year low in January, to 0.8 percent year-on-year and negative 4.3 percent year-on-year respectively.

Although the shifting timing of Chinese New Year was to blame, underlying sequential momentum of core inflation (e.g., seasonally and CNY adjusted 3-month growth) did sink to the slowest pace since the global financial crisis. We expect February inflation will not have rebounded above 1 percent, adding further deflationary concerns.

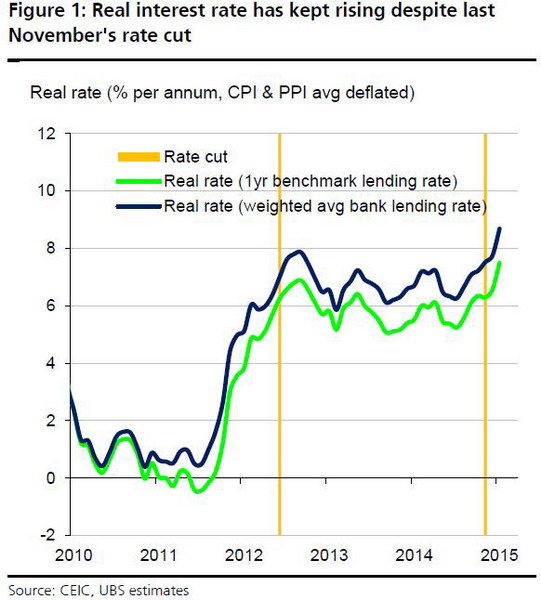

The decline in inflation has rapidly pushed up real interest rate. The average of CPI and PPI has dropped substantially by 170 bps since Q4 2014 and 250 bps during the past 6 months, while the nominal interest rate has remained sticky despite the November rate cut, with average bank lending rates edging down only around 20 bps and our estimated overall financial cost barely moving. As a result, the real rate has moved up by +100 bps since Q4 2014 according to our estimation.

Rapid increase in real interest rates means a tightening of monetary conditions, which stands in sharp contrast with softening real activity growth. Moreover, financial burden on the corporate sector has been aggravated. With industrial profit growth already mired in recession (total profit decreased 6 percent year-on-year and principal business profit fell 9 percent year-on-year in Q4 last year), risks are quickly building up at the financial system, prompting more monetary accommodation to mitigate massive tightening and contain financial risk.

PBOC has clearly become more concerned about deflationary pressure in recent weeks, as reflected in the latest monetary policy report and two PBOC research articles warning against deflationary pressures.

This cut in the benchmark rate should help lower the lending rate charged by banks, though the 25bps cut may not be passed through entirely since the ceiling on deposit rates are raised again, which effectively means an asymmetric rate cut and could squeeze banks' interest margin. The rate move can also help anchor inflation expectations before deflationary forces become entrenched. The resulting drop in real interest rates should help mitigate the worsening financial burden for the real economy and reduce the negative pressure on banks' asset quality, thereby containing financial risks.

Further monetary easing is still needed

Although one rate cut is helpful at the margin, it is insufficient to offset the passive tightening of monetary conditions so far, in our view. As highlighted in our earlier report, we think the PBOC should cut benchmark lending rates by 100 bps this year to keep real rates from rising, but expect the PBOC to only cut 50-75 bps. Therefore, more monetary accommodation is still warranted. The next rate cut could come in Q2 following persistent deflationary pressure and weak activity data.

In addition to the rate cut, we also believe the central bank need to cut RRR and use liquidity operations to help offset the drop in foreign exchange related liquidity, and ease loan quota and other lending restrictions.

To better support growth, we believe fiscal easing, relaxation of property policies (including cut of down payment requirement and transaction related taxes), and pro-growth reforms are likely in 2015, and see these measures to be more effective than monetary easing.

This article is co-authored with Harrison Hu, both UBS economists. The views do not necessarily reflect those of China Daily.