|

|

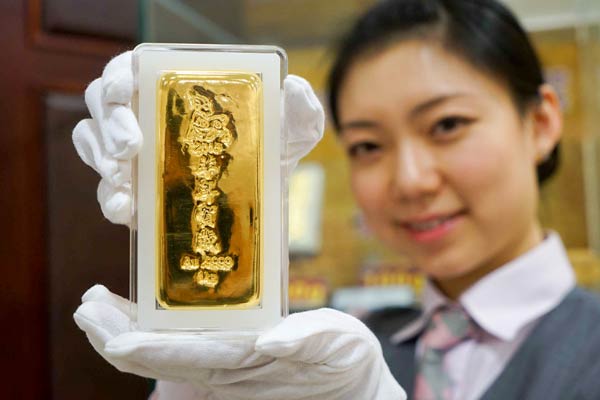

Gold bars marking the 2015 Sheep Lunar New Year, which are issued by China Gold Coin Inc. [Photo/Xinhua] |

A new electronic daily gold pricing mechanism, set to launch on March 20, will include more participants in setting the benchmark price of the precious metal, including Chinese banks such as Industrial and Commercial Bank of China Ltd.

The Intercontinental Exchange and the London Bullion Market Association will replace the current private telephone conference between a group of just four banks, the remnants of a system that has existed since 1919.

But from March 20, the gold benchmark will be set via an electronic platform managed by ICE Benchmark Administration.

The LBMA hopes the new pricing mechanism will increase the number of participants in the gold market. Bank of China Ltd, China Construction Bank Corp and ICBC are already members.

ICBC confirmed it had already laid the foundations for its participation in a press release on Monday.

"ICBC has become the world's largest gold retail bank and has a significant number of clients in China," the release said.

Ruth Crowell, LBMA's chief executive, said she was encouraged by the high level of interest by more participants in the March launch.

Once it makes the switch, all four precious metals-gold, silver, platinum and palladium-will have made the move to the electronic platform.

Although it is still unclear how many will participate in the new system, according to a recent report by Reuters, about 11 institutions will be included.

Market insiders and analysts said that with more participants the mechanism is likely to become more transparent and better serve global gold market players, from mining corporations to end users.

"The new mechanism is an open platform which enables interested participants to join in and reflect their views," said Albert Cheng, managing director for the Far East at the World Gold Council.

In the past, Chinese participants including banks, mining companies and traders could also participate in setting the benchmark price in an indirect way through market maker banks, said Cheng.

"If Chinese banks choose to join in the new mechanism, then as a result Chinese clients will have a more direct say in future pricing of the precious metal."

Jiang Xueqing in Beijing contributed to this story.