|

|

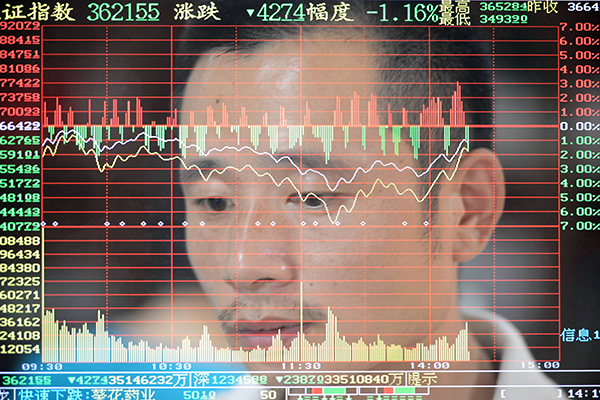

The registration-based IPO reform envisaged by the 13th Five-Year Plan (2016-20) might be a factor in future market trends. [Photo/China Daily] |

Worries center over next month's release of economic data of Q1 performance

The Chinese stock markets will be under mounting pressure to sell if key economic data to be released next month fails to meet investors' expectations and indicates rising inflation is imminent, analysts said.

The selling pressure comes after a robust rebound in the benchmark Shanghai Composite Index last week buoyed by positive signals from financial regulators that the market is stable and that overseas conditions have improved.

But Xiao Shijun, an analyst at Guodu Securities Co, said investors should watch out for midterm risks, including concerns over a potential US Federal Reserve rate hike next month. But the most important thing to watch for is economic data about China's first quarter performance, due to be released in mid-April, Xiao said.

"If the data fails to meet investors' expectations ... fears of stagflation (where inflation is high while growth remains slow) will prompt selling in the market," Xiao said. "The Fed is likely to usher a more hawkish tone with its interest rate policy in its meeting in April. That will again tug at the nerves of global markets."

Hong Hao, chief strategist at investment bank BOCOM International Co Ltd, said a number of factors, such as volatility in commodity prices and a worrying divergence in China's property prices, could soon create concerns of higher inflation amid a continued economic slowdown.

"While investors may opt for risk-rotation trades due to peer pressure, bear market rallies are better for trading, not holding," Hong said.

The Shanghai Composite Index gained 0.82 percent last week amid positive results from both home and international markets. Monetary authorities in the eurozone and in Japan maintained policies of negative interest rates to spur growth while the US Federal Reserve said earlier last week that it would keep rates unchanged despite healthy job figures, though there were grumbles by Thursday of a rate hike.

Commodity prices also rebounded after the Organization of the Petroleum Exporting Countries began negotiations to cut production in an attempt to stem the plunge in oil prices.

At home, the People's Bank of China, the nation's central bank, continued to guide interest rates lower through short- and midterm lending facilities with commercial banks.

Property sector investments began to pick up in the first quarter despite a widening gap in housing prices between big cities and smaller ones. Government leaders in Beijing are now faced with the daunting challenge of trying to cool an overheated property market in first-tier cities while addressing an excess in supply in smaller cities.

"The momentum from cyclical sectors will soon be overshadowed by concerns over higher inflation and slowing growth. If price increases are not from rising demand due to a fundamental recovery, the sustainability of a rebound will be in doubt," Hong said.

Wendy Liu, chief China strategist at Nomura Securities, said recent market trends reaffirmed her call for selling during rallies in the first quarter and buying on dips in the second quarter.

"The positive catalysts we forecast in our call for an interim rally into April have either materialized or are materializing," Liu said.

Investors were relieved after the central government indicated a delay in the registration-based IPO system and omitted the phrase of "setting up strategic emerging industries board" in its new economic Five-Year Plan (2016-20).

"Investors will be very cautious over a supply of new shares in the market," said Xue Hexiang, an analyst at Huatai Securities.