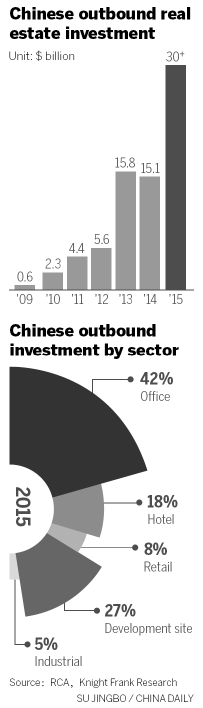

Chinese outbound real estate investment continued to grow with the support of policies like the Belt and Road Initiative, reaching nearly $30 billion in 2015 and doubling that of 2014, a report by the global property consultancy Knight Frank said.

Most of the investments were in gateway cities such as New York, London, Sydney, and regional hubs like Chicago and Seattle.

A Knight Frank analyst forecast further growth in outbound real estate investments this year despite the Chinese economic slowdown.

"Going forward, as Chinese capital outflow increases with policy support such as the Belt and Road Initiative, the Asian Infrastructure Investment Bank and China's trade and financial initiatives, capital outflow will become increasingly sustainable," said David Ji, director and head of research and consultancy at Knight Frank China.

"This means ample opportunities for gateway markets and key regional hubs."

Ji said China's institutional investors as well as banks and insurers are focused on commercial properties with stable returns, which show their preference for deals with lower risks.

In the future, developers may also look into opportunities in the emerging markets of Southeast Asia and South Asia. Residential properties will be their first considerations in cities with demands supported by demographic and commercial conditions.

In 2015, the top 10 overseas deals completed by Chinese mainland insurers, institutions and developers focused on commercial properties, particularly office real estate, according to data from Real Capital Analytics, a research and information services provider.

For example, Ping An Insurance (Group) Co purchased Tower Place in London for $506 million in January 2015, and Anbang Insurance Group Co purchase Merrilll Lynch Financial Center in New York for $414 million.

Insurance giants in particular continue to splash out on trophy properties. There has been significantly increased investment in commercial real estate in the United States, making it the fastest-growing mature market. Meanwhile strong growth in Australia continues unabated while investment in the United Kingdom is on par with that of 2014.

Knight Frank's report said a mixed group of investors consisting of lesser known small-to-mid-cap companies and developers, private equity funds and individuals are increasingly active and their investments in mature markets will also grow in the future.

As for individual outbound real estate investors in China, more will choose to allocate their assets in residential properties and their investment decisions are more closely linked to their children's education and their own demands for care for years after retiring. Destinations with good education resources and ample natural landscape resources will be priorities, said the report.