Mergers and acquisitions in China's hospital sector became a new focus in 2015, and large-scale deals and more cross-border transactions will likely be made in the near future, said a report by global auditing firm PricewaterhouseCoopers on Thursday.

There were 48 mergers and acquisitions of Chinese hospitals last year, of which 27 were general hospitals and their disclosed investment amount totaled 3.98 billion yuan ($612.1 million). In contrast, the disclosed value for specialized hospitals fell sharply in 2015 compared to 2014.

Leon Qian, PwC northern China transaction services & healthcare industry leader, said investors were previously attracted to specialized hospitals, especially dental, obstetric and paediatric hospitals, as they had low risk and could be easily replicated and enlarged to generate profits.

"However, with more capital flowing in, such targets (specialized hospitals) had become scarce, which led to a dramatic drop in investment in 2015. Also in 2015, general hospitals became the main focus of investment as they yielded stable cash flows and tended to offer the most benefit for new funding," said Qian.

The report also showed that there has been a rise in investment activity in public hospitals, with their total disclosed deal value reaching 844 million yuan in 2015.

Investment in private hospitals reached a record high in 2014 in both the volume and value. However, in 2015, the deal value plunged to 3.94 billion yuan, largely because of fewer deals associated with specialized hospitals.

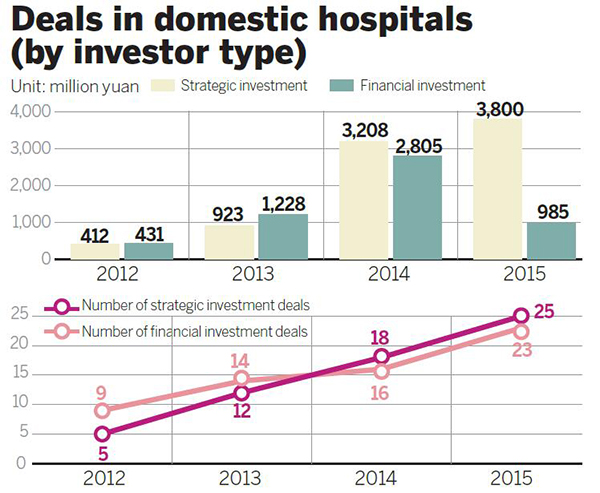

Notably, the rising role of strategic investors, in particular A-share listed companies, in hospitals has elicited exponential growth in deal value since 2014. The disclosed investment amount totaled 3.8 billion yuan in 2015.

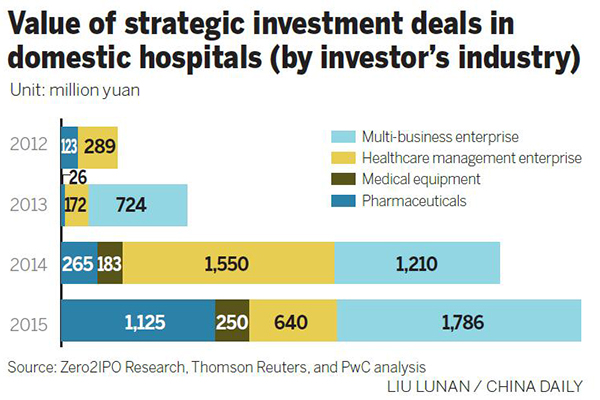

"Strategic investors are looking to explore horizontal integration with A-share listed healthcare companies, including pharmaceutical, medical equipment and healthcare management enterprises," said Jin Jun, PwC China strategy consulting partner.

Despite the strong interest of financial investors such as private equity funds in healthcare, the disclosed deal value dropped to 985 million yuan in 2015, decreasing by approximately 65 percent compared with 2014.

"With strategic investors continuing to have a strong interest in the healthcare market and financial investors willing to pour more money into the industry, large-scale deals will likely be made in the near future, including hospital group or standalone hospital acquisitions," said Jin.

Jin added that more cross-border transactions are expected to be conducted in various ways, such as consolidation and joint ventures, and healthcare company IPOs will be more popular in capital market.

The report also said China's investment trends in healthcare saw a shift from traditional targets, such as medical examination centers and dental clinics, to core business areas including hospitals, rehabilitation centers and clinics in the past four years.