|

|

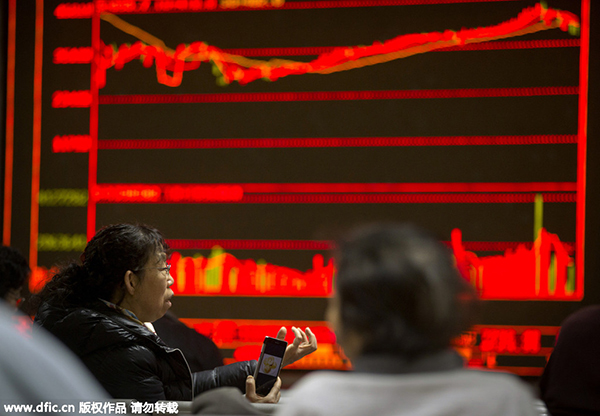

An investor looks at stock prices in a brokerage house in Beijing, Jan 8, 2016. [Photo/IC] |

BEIJING - China's two stock exchanges have set the upper-time limit for listed firms' trading suspension, a move that could bolster the case for China's onshore stock market to be included into widely tracked global indices.

Listed firms on the Shanghai and Shenzhen bourses seeking to suspend trading over important asset reorganization should finish the process within a time frame of no longer than three months, according to statements released by the two institutions on Friday.

Similar time limits were also rolled out for continuous plans for asset reorganization, non-public offerings and major asset purchase.

Over 1,400 companies suspended their Shanghai- and Shenzhen-listed shares to prevent stock prices from plunging further after the mainland stock market underwent a major correction in June last year.

Such arbitrary trading suspension drew fresh concern from foreign institutional investors when global stock index compiler MSCI consulted investors about adding China's yuan-denominated A shares into its widely-tracked benchmarks.

MSCI has been reviewing the case to add China's A-share market into its benchmarks since 2014.

"The arbitrary share suspension is a shared concern of regulators and investors both in China and abroad." said Gao Ting, head of China strategy at UBS Securities.

Around 300 companies were suspended from trading in April this year, half of which cited restructuring as reason while another 40 percent only vaguely described their reason for suspension as "important events," according to Goldman Sachs.

MSCI will announce its decision on the A-share's inclusion next month after it reviews China's onshore stock market's eligibility based on consultations with fund managers tracking its indices.

China's stock market is the world's second largest by both market capitalization and turnover but representation in globally-tracked indices is relatively low. The MSCI China index, which tracks Chinese firms listed in offshore exchanges in places like Hong Kong and the United States, is only 2.4 percent of the MSCI AC World Index.

Such low representation is disproportionate to China's growing economic influence. The world's second largest economy contributed 13 percent to global GDP, 12 percent to international trade and 9 percent of consumption worldwide in 2014, statistics from Goldman Sachs show.

Authorities in China are also seeking greater participation by foreign institutional investors in the domestic stock market.

Foreign investors are allowed to participate in China's onshore stock market through quota-based projects including qualified programs such as foreign institutional investor (QFII) and RQFII, which allows institutions to raise renminbi from the offshore market to invest in China.

China also launched the Shanghai-Hong Kong Stock Connect in late 2014 to let investors on the mainland and those based in Hong Kong to trade select stocks on each other's exchanges, which are also subject to daily and aggregate quotas.

A similar connect linking the bourses in Shenzhen and Hong Kong is expected some time this year, further expanding overseas investor's exposure to China's onshore stock market.

As of March this year, overseas investors have been able to invest up to 199 billion dollars under the QFII, RQFII and stock connect programs, which is equivalent to eight percent of the free flow market capitalization of China's stock market, data compiled by Goldman Sachs shows.

MSCI declined to include A-share into its emerging market index in its 2015 review, citing issues such as the inflexible QFII quota allocation among foreign investors and the Chinese regulator's constraint over cross-border capital flow, which could limit overseas institutional investors' ability to repatriate funds.

Chinese regulators have made concrete steps to address some of the obstacles identified in the MSCI review last year.

Authorities have began linking QFII quota allocation to the size of offshore investment funds. It also relaxed capital flow restrictions for QFII and RQFII funds and simplified quota application and the granting process.

Many investment banks expect MSCI to include, if at all this year, 5 percent of China's A-share market capitalization in its emerging market index. This could potentially draw around 7.8 billion dollars of additional capital flow to the A-share market.

"I think the probability of inclusion is higher than last year as regulators made progress in removing technical obstacles but it is after all a decision by the index compiler based on their consultation with clients," Gao explained.