|

|

A customer stands at a currency exchange in Hong Kong. [Photo/Agencies] |

In the offshore markets for the yuan, the expectation is spreading that the currency will depreciate until there is a turning point in the global business environment. But, how quickly will the yuan fall against the dollar? Or, how much will it be allowed to fall, based on China's overall economic considerations?

Economists are offering different scenarios. But many tend to agree, as a recent Bloomberg report reflects, that the central government won't allow the rate to fall below 7 to 1 in the second half of the year.

The yuan gained 96 basis points to 6.6893 per US dollar as of the 4:30 pm official closing time in Shanghai on Tuesday, recovering from 6.7021 on Monday's close, the weakest level since September 2010.

The value of the offshore yuan in Hong Kong increased to 6.7044 as of 7:00 pm, according to data compiled by The Wall Street Journal.

The People's Bank of China set the yuan reference rate at 6.6961 on Monday, almost at its lowest level in six years, due to a 0.6 percent growth in the US dollar Index on Friday.

Analysts said they believe that, once the mainland cuts interest rates, or, as is widely expected later this year, the US raises them, the yuan will depreciate further.

"However, we don't think there'll be a sharp depreciation of the yuan because the US Federal Reserve is unlikely to raise rates within this year, keeping a lid on the US dollar in the second half," JPMorgan Asset Management's global market strategist Ben Luk said on Monday.

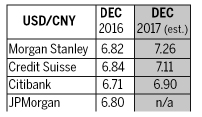

"We expect the yuan to depreciate mildly to 6.8 against the US dollar at the end of 2016, following a basket of currencies."

Luk acknowledged there's the possibility that a US rate hike will happen in December. "But given the high levels of uncertainty in the global market, the next rate hike will more likely happen in 2017," he noted.

He said the possibility of a rate cut in China will be higher than a reduction in the reserve requirement ratio, signaling possibly cheaper credit later this year to boost investment and support the property market, a pillar of the Chinese economy.

"We believe there will be a rate cut of 25 basis points if the mainland's property and infrastructure investment stagnates amid an economic slowdown in the next half year," he said.

On the other hand, the lukewarm property market gained momentum in the first half of this year, helping the nation's gross domestic product grow 6.7 percent and reducing the need for more stimulus.