|

|

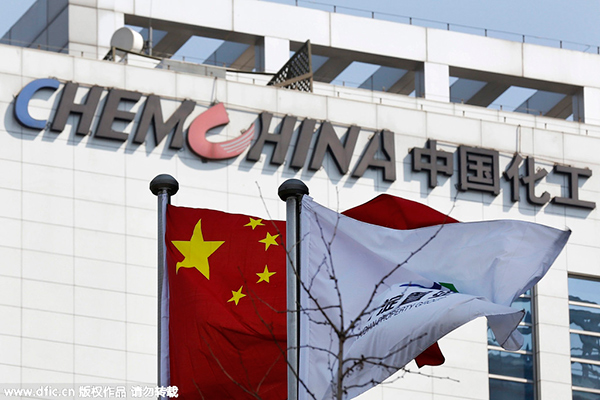

A Chinese national flag and a company flag fly in front the logo of China National Chemical Corporation at the company's headquarters in Beijing, Mar 24, 2015. China National Chemical Corp purchased Swiss-based Syngenta AG for about $43 billion in 2016. [Photo/IC] |

China has surpassed the US as the largest source of outbound mergers-and-acquisition activity as a built-up mainland looks for other investment opportunities overseas.

According to Dealogic, in the first nine months of the year the total value of mergers and acquisitions (M&A) by Chinese companies jumped 68 per cent year-on-year to $173.9 billion. It was the first time China has done more deals than the US. Dealogic said the US had been the top cross-border acquirer since 2008.

Analysts said a slowdown in domestic growth due to a mainland economy that is emphasizing services and consumption over manufacturing exports, and a depreciating currency that could make future deals more expensive are helping to spur the Chinese shopping spree.

"China's outbound M&A activity will reach a new high this year because there are diminishing investment opportunities in the home market," commented David Dollar, a senior fellow at the Brookings Institution's John L Thornton China Center in Washington. "China has built up excess capacity in a wide range of sectors so that profitability has dropped and new investment opportunities have shrunk."

Jian Yang, director of the Center for China Financial Research at the University of Colorado Denver Business School, noted in an email that the "Chinese government makes very conscious efforts to promote outbound M&A activities by Chinese companies, and its policy plays a crucial role in this regard."

Notable Chinese acquisitions this year include China National Chemical Corp's purchase of Swiss-based Syngenta AG for about $43 billion. Earlier, China National Chemical also said it would buy German machine maker KraussMaffei Group for $1 billion. A unit of aluminum maker China Zhongwang Holdings Ltd agreed to acquire US-based Aleris Corp in a deal valued at about $2.33 billion.

Michael DeFranco, chairman of the Baker & McKenzie LLP law firm's global M&A practice, said in an email that the majority of Chinese M&A in the US this year is in strategic investments - "real economy firms investing in their core areas of business whether it is consumer goods, entertainment or automotive".

"I think we will see the same broad mix of sectors with a real economy focus of technology, leisure, automotive and materials," he said of possible Chinese US acquisition targets in 2017.

"In 2017, we can expect continued strong outbound M&A activity by Chinese firms and generally a continuation of several target sectors for Chinese acquirers," said Yang. "Technology and financial services probably will continue to be among the most favored sectors for outbound acquisitions by Chinese companies. It remains to be seen whether the hospitality industry will still be a favorite target in 2017."

The US is one of the biggest recipients of this investment because it is very open and provides attractive acquisition targets. Many of the Chinese firms that are buying foreign assets are State-owned enterprises (SOEs) like China National Chemical, and that could pose problems for future Chinese purchases especially in the US, warned Dollar of the Brookings Institution.

"As evidenced in the (US presidential) election campaigns, Americans are increasingly unhappy that China's state enterprises are making these purchases while China itself remains quite closed," he said. "US firms cannot go into China and make similar purchases. It is unlikely that this asymmetry can last," he wrote.

Yang said there is a potential increase in political risk in the US that could affect some deals, particularly those in the technology sector, which could fail a national security review from the Committee on Foreign Investment in the US or CFIUS.

paulwelitzkin@chinadailyusa.com