Li Ka-shing bids $5.4b for Duet

|

|

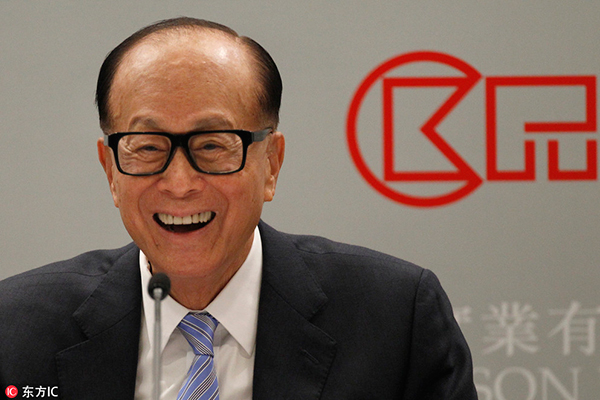

Hong Kong tycoon Li Ka-shing speaks during a press conference announcing CK Hutchison Holdings' company results in Hong Kong, March 17, 2016. [Photo/IC] |

Hong Kong billionaire Li Ka-shing's Cheung Kong Infrastructure Holdings Ltd has offered A$7.3 billion ($5.4 billion) in cash for Australia's Duet Group as it seeks to expand its power and gas pipeline assets.

CKI offered A$3 per share for the infrastructure company, 28 percent more than Friday's close, Sydney-based Duet said on Monday.

The company's board said it is evaluating the nonbinding and conditional offer that pushed its shares to the highest level in eight years.

The bid is the latest attempt by Li to bolster his Australian business this year. The tycoon experienced a setback in August when Australia's Foreign Investment Review Board blocked CKI from buying a majority stake in state-owned power network Ausgrid on security concerns.

"FIRB approvals remain a significant barrier to a deal proceeding," Paul Johnston, an analyst at RBC Capital Markets in Melbourne, said in a note to clients after the deal was first reported.

CKI may have to take on an Australian partner to help secure approval, Johnston said, and noted local pension fund UniSuper already has a 16 percent stake.

Duet's shares jumped as much as 20 percent to A$2.82, the highest since Sept 10, 2008. UniSuper's investment team is waiting for more information on the deal, a spokeswoman said.

CKI already owns stakes in Australian assets including SA Power Networks, Powercor Australia and Australian Gas Networks. The Duet deal would be Li's biggest acquisition in the nation. Wendy Tong Barnes, a spokeswoman for CKI, declined to comment.

Macquarie Capital is advising Duet, according to the statement.

Duet's assets include the Dampier-Bunbury pipeline in Western Australia, a stake in electricity distributor United Energy, gas distribution business Multinet Gas, pipelines business DBP Development Group and Energy Developments Ltd, according to Duet's website.

Separately, CK Hutchison said last week that Indian tax authorities had proposed the conglomerate pay HK$8.9 billion ($1.15 billion) of capital gains tax on a transaction in 2007, when it sold its Indian telecom business to Vodafone International Holdings BV.

Bloomberg