Takeover activity set to pick up this year

|

|

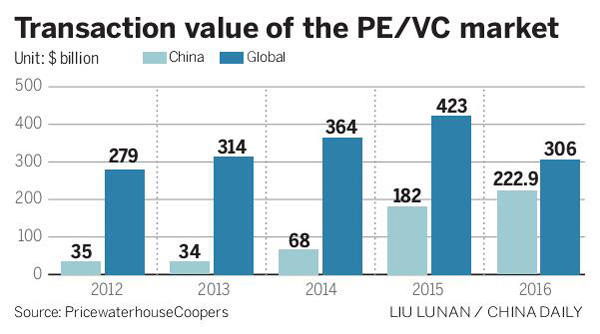

A total of $532 billion was raised in the Chinese private equity and venture capital market from 2006 to 2016, according to a report issued on Thursday by PricewaterhouseCoopers. [Photo/China Daily] |

Chinese private equity and venture capital-led merger and acquisition activities will be more active in 2017 after their deal value set a new record in 2016, according to a report issued on Thursday by PricewaterhouseCoopers.

"As the pressure to invest large sums of available funds increases, we expect an increase in M&A activities led by PE/VC," said Amanda Zhang, PwC's North China private equity group leader.

A total of $532 billion was raised in the Chinese private equity and venture capital market from 2006 to 2016, it showed.

The report also said that total China PE/VC-led deal values increased 22.5 percent year-on-year to reach $223 billion in 2016, accounting for 73 percent of global PE/VC deal values last year.

"The strong growth was driven by the participation of 'big asset management' investors who dominated the list of large transactions," said Nelson Lou, PwC Beijing advisory leader.

"Chinese PE/VC funds' overseas M&A activities have taken off rapidly, becoming a force to be reckoned with. Investors pursued overseas assets 'with a China angle', aligning with their growth strategies, while focusing on geographical and currency diversification," said Lou.

In terms of deal volumes, high technology remained the PE funds' most favored sector in 2016. In terms of deal value, PE investment in real estate driven by big asset management and outbound M&A, nearly doubled in 2016.

Driven by a substantial increasing amount of renminbi fundraising, $72.5 billion was raised by China PE and VC in 2016, a 49 percent growth over 2015, while the scale of global PE and VC fundraising fell to $336 billion in 2016 from $347 billion in 2015

"Traditional PE and VC fundraising was dominated by the renminbi for the first time, with a plethora of medium and small renminbi funds raising money for domestic investment and A share-related activities and exits," said Ni Qing, PwC China private equity group funds audit partner.

The report also said the backlog of projects awaiting exits continues to face challenges. Although IPO exits reached a new height with 165 deals, a 38.7 percent increase from last year, M&A exit deals fell unexpectedly to the lowest level in four years.