Robo-advisers help investors instead of wealth managers

|

|

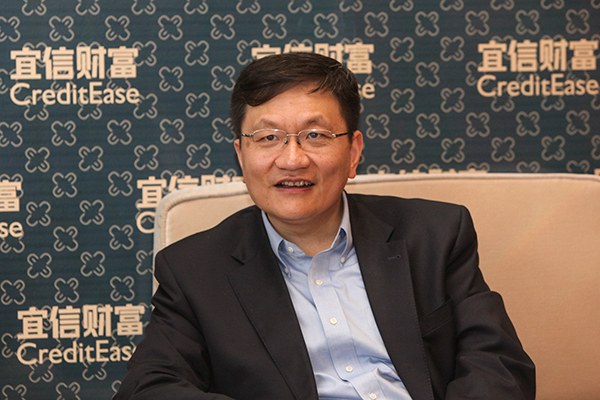

Tang Ning, CEO of CreditEase Corp. [Photo provided to China Daily] |

Leading Chinese peer-to-peer lending and wealth management company CreditEase Corp is developing a robo-adviser product to serve small and medium domestic investors.

A robo-adviser is an online wealth management service that provides automated, algorithm-based portfolio management advice without the use of human financial planners.

"With business patterns and innovation, small and medium investors can enjoy personalized financial services and better manage their wealth," said Tang Ning, CEO of CreditEase Corp.

"We are largely developing a robo-adviser product, ToumiRA, to serve these customers."

Tang said they have about 1 million small and medium investors at their platform.

Launched in June, ToumiRA is a robo-adviser mobile application that can create asset allocation solutions for investors based on their investment goals and risk preferences. The threshold to be an investor is $500.

ToumiRA's portfolio includes exchange traded funds of equity, bond, gold and real estate in both developed countries and emerging markets.

According to Tang, the robo adviser can assess hundreds of clients a day. In traditional wealth management, an expert can assess no more than 10 clients a day.

"Thus, the automated wealth management service will greatly decrease fees and increase efficiency," said Tang.

According to Tang, the robo adviser has a strong capacity for risk control. For instance, ToumiRA suffered a very small loss in the first two weeks after the Brexit vote.

Meanwhile, CreditEase is also developing big data technology to help evaluate individuals' creditworthiness.

Tang said by adopting big data technology, they are able to provide inexpensive but better service to customers.

Zhang Shishi, president of the New Finance Group, said mobility, data and intelligence will be vital for fintech.

"In the past five years, mobility and data have been widely used in the fintech sector, and intelligence will be significant for the sector in the coming five years," said Zhang.

Zhang also said that robo-adviser products will be popular because they can offer small and medium investors private banking services.

The New Finance Group is also launching a mobile application called Black Card to offer white collar investors intelligent financial and life services.

Separately, Citigroup Inc released a report that assets under management by robo advisers increased to $18.7 billion at the end of 2015, while in 2012 the amount under management was close to zero.

According to a report from AT Kearney, the compound annual growth rate of the global robo-adviser market will be 68 percent for the coming three to five years and the market value in 2020 will total $2.2 trillion.

Wang An, chief brand officer of Caifupai, belonging to the New York-listed Noah Holdings Ltd, a wealth and asset management services provider, said robo advisers will be key to supplementing traditional wealth management.

Caifupai, which was launched in 2014 by Noah, is a proprietary internet finance platform to provide financial products to aspiring high-net-worth individuals and enterprises in China.

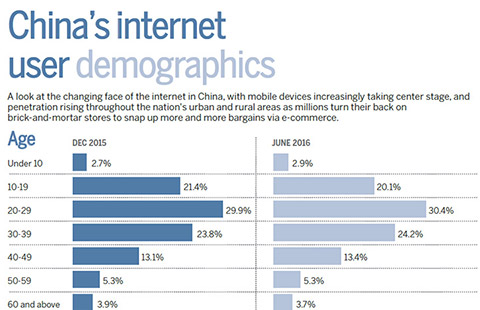

"But it will take some time for the automated wealth management tools to really provide services for individual investors as the country has yet to develop a large database of users of online wealth management tools," Wang said.

Qiu Quanlin contributed to the story.