China will allow more borrowing by local governments as part of a surging fiscal deficit this year, which may be a long-term mechanism to stimulate growth and promote urbanization, experts said.

Government expenditures are projected to exceed revenue by 1.2 trillion yuan ($192.8 billion) in 2013, an increase of 400 billion yuan from last year, according to the annual budget report handed to deputies of the 12th National People's Congress, which opened in Beijing on Tuesday.

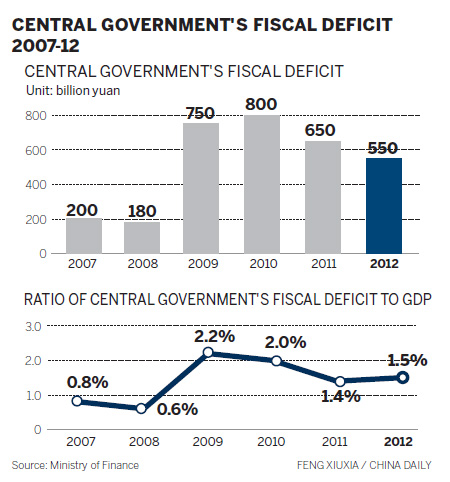

The deficit is equivalent to about 2 percent of GDP this year, up from 1.5 percent in 2012, a result of less government revenue and rising public spending.

China's government deficit ratio dropped from 2.2 percent in 2009 to about 1.5 percent last year, and both the deficit and debt levels are within the safe zone now, Premier Wen Jiabao said in his Government Work Report.

According to Wen, the larger deficit this year was due to the lag effect of past structural tax cuts, and "it will be hard for government revenue to grow fast this year".

At the same time, "increased expenditures on improving the people's livelihood and supporting economic growth require larger fiscal deficits and more bonds issued by central and local governments", said the premier.

"A 2 percent (deficit ratio) is an appropriate amount that reflects the country's prudent and proactive fiscal policy," said Zhao Quanhou, head of financial research with the Fiscal Science Research Center at the Finance Ministry.

Zhao said China's deficit level is still relatively low compared with most developed countries, of which the deficit-to-GDP ratios are well above 3 percent, a global standard for safety.

"The deficit ratio will remain at around 2 percent over the long term if economic growth stays above 7 percent, but it may rise to above 3 percent if growth sees a sharp decline," he said.

An increased deficit will ensure that the government has enough money to increase investment in education, healthcare and social security, said Gao Peiyong, head of the National Academy of Economic Strategy under the Chinese Academy of Social Sciences.

On the local government level, there will be a 350 billion yuan shortfall in expenditures compared to revenue, which will be made up by bonds issued by the Ministry of Finance on behalf of local governments.

Bond-issuing this year will be increased by 100 billion yuan from last year's 250 billion yuan, adding pressure to the already huge local debt that stood at an estimated 12 trillion yuan at the end of 2012.

"Local government plays a major role in undertaking the mission to further China's urbanization, and the financing needs of projects such as affordable housing must be guaranteed," Zhao said.

In addition, he said, it will be safer to raise money via bond issuing by the Finance Ministry than to allow more fund-raising via local government financing vehicles and private equity funds, which will be even harder to manage.

According to Wen, a warning mechanism will be established to prevent overexpansion of the debt.

Shang Yong, deputy Party chief of Jiangxi province and an NPC deputy, said there should be different regulatory standards on financing for local governments at different development levels.

"For less developed areas like Jiangxi, where the debt is still relatively small, there should be not only fiscal incentives but also more credit support to spur growth," he said.

Jia Kang, a member of the Chinese People's Political Consultative Conference National Committee and a researcher with the Finance Ministry, said the larger government deficit needs better management and more transparency.

"It requires lower administration costs and more efficient use of capital."

Dong Dasheng, deputy auditor-general of the National Audit Office and a CPPCC National Committee member, said current government debt totaled 15 to 18 trillion yuan, much less than the 50 trillion yuan some analysts estimated.

He said authorities should carefully control fiscal expansion, and should separate the debt budget from the general public budget.

In addition, he said, "local government should be granted independent bond issuing rights, which can be approved by the local people's congress."

Contact the writers at weitian@chinadaily.com.cn and wangxiaotian@chinadaily.com.cn

Xin Dingding contributed to this story.