Growth and equality the new drivers for investment

Updated: 2013-03-06 11:07

Making predictions is always a hazardous game, particularly on matters that relate to the economic health of a nation, considering that there are many hidden bumps.

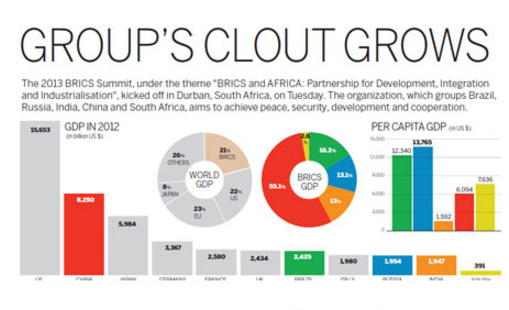

But the foremost question on everyone's minds as the new leadership gets ready to take the helm, is whether China will opt for a rebalancing and re-engineering of its economy by investing less and consuming more. Such doubts have resurfaced after recent reports indicated that due to over-investment, returns on capital have been languishing and could cramp future growth in China.

Global ratings agency Standard & Poor's in a recent report indicated that investment levels in China have run ahead of the returns on investment over the past five years. "China has the highest risk of an economic correction, because of low investment productivity over recent years," S&P credit analyst Terry Chan said in the report.

Since investment accounts for more than half of China's GDP, it looks highly unlikely that the government would contemplate a sudden complete course correction by slowing investment. Rather, the onus would be on more steps to stimulate consumption and reorient investment in such a manner as not to hamper economic growth. Also on the cards would be steps to increase household incomes, a key ingredient for raising consumption.

But at the same time, policymakers may find it hard to quantify how much investment is enough for China. Though the global investment climate continues to be grim, the investment pipeline is still robust in China. Rather than cap this pipeline, it is important for policymakers to direct investment to new areas and in new directions in line with China's newfound economic standing.

Changing the current capital-intensive growth model to a more labor-intensive and consumer-friendly approach is one of the ways that the new leadership can reduce economic inequalities and to maintain social harmony and fairness.

Yet another option before the new government would be ways to reduce the influence of State-owned enterprises and local governments, a step that would help China move to a more dynamic and consumer-led growth model.

The International Monetary Fund in a recent report said the main challenge for China would be to engineer a gradual reduction in investment in such a manner that it maximizes social welfare.

What distinguishes China from the rest is its self-reliance on the resources of investment, like high savings. In other countries, the high cost from excess investment has been reflected in the form of bank stress or foreign exchange market crisis, but in China it is mirrored in the subsidy system, says the IMF report.

There have already been early indications from the new leadership that it is aware of the investment conundrum and is taking steps to address the issue. The land and household registration systems are likely to see major overhauls and that in turn could spur more urban migration, and significantly translate into more demand and investment.

In the manufacturing sector, there are indications that investment patterns are changing. The old focus on cheap labor, low-cost and mass manufacturing is giving way to high-end, high-tech and precision manufacturing.

The new leadership will also outline a strategy that will see industries focusing more on quality, rather than on quantity. Research and development, along with high-tech education, are likely to benefit from the new thrust.

Green projects are another area the government will focus on more to drive investment and growth. Fixed-asset investments like subways will continue to be high on the government agenda, as will projects to improve air quality in major cities.

Reforms have always been the backbone of investment, and there are enough indications that this will continue to be an important policy tool for the new leadership. Financial reforms and more muscle for the capital markets are expected to give new impetus to the financial sector in China and also act as a magnet for more overseas investment.

In other words, promoting sustainable growth and maintaining social equality will be the new drivers for investment in China.

Man Ranjith U is a senior editor of China Daily's international editions.