|

|

|

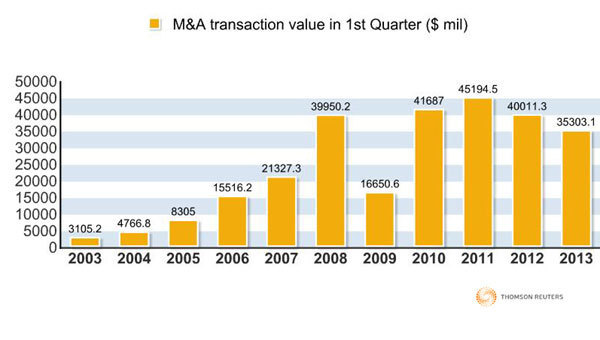

Year on year comparison of 1st quarter M&A transaction value for 10 years. [Data from Thomson Reuters] |

There have been 562 merger and acquisition deals related to Chinese companies this year with a value of $35.3 billion, decreasing 11.8 percent year-on-year, according to data from Thomson Reuters released on Thursday.

But experts said the condition of the Chinese M&A market remains steady in the first quarter and will be positive this year.

"One reason for the small decrease in the first quarter may be that buyers at home and abroad are waiting for China's leadership transition to take effect," said Nie Lei, a partner of transaction services at PwC China.

He added that preparation work for M&A deals slowed down around November 2012, when the 18th National Congress of the Communist Party of China was held, influencing the number and value of deals announced in the first three months of this year.

Thomson Reuters data also showed that private equity and venture capital investors only invested $84 million in these deals, a decrease of 97.5 percent year-on-year.

"Because of difficulties in raising funds and exits, the activities of PE and VC investors have been less active," said Wan Ge, an analyst at ChinaVenture Group, a Chinese leading PE research agency.

Deal activity of PE and VC companies is likely to be strengthened in the second quarter of 2013 as global economic conditions become more settled, pricing expectations for China adjust, IPO markets re-open and China's leadership transition takes effect, said Vincent Cheuk, Northern China head of the private equity group at PwC China.

The value of deals in financial and material sectors accounted for 40.2 percent of all M&A deals that have taken place in China, largely because deals in these two sectors are large ones.

The value of outbound M&A deals by Chinese companies topped $2.72 billion; most of the deals were associated with the energy and power generation industry.

The largest one was CNOOC Ltd's $15.1 billion takeover of Canadian oil and gas company Nexen Inc in February.

The United States was the main destination for Chinese firms making M&A deals. These types of M&As have totaled seven in number and $3.62 billion in value so far this year.

But Leon Qian, of PwC Northern China transaction services, said companies in the United States are usually very large and their industry chains are long with many stakeholders involved, so it is not easy for Chinese companies to conduct M&A deals in the US.

"It seems Europe is the region Chinese companies like and are confident to go to," said Qian.

caixiao@chinadaily.com.cn