|

Alibaba Group Holding Ltd, the country's largest e-commerce company, plans to provide financing services to customers. [Photo/Provided to China Daily]

|

Led by Alipay, a new generation of online 'banks' are now flexing their financial muscles

It's not an easy task to compete with banks, whose sheer size may be too big for latecomers to handle. But there are exceptions.

Third-party payment companies, after a decade of fast development, are providing not only payment services but also services traditionally provided by banks, such as loans.

Among these companies, Alibaba Group Holding Ltd - China's largest e-commerce company - has gone further than others. Alibaba plans to set up Alibaba Small and Micro Financial Services Group to consolidate its online payment and micro loan businesses, and provide financial services for consumers and small and micro enterprises - those with an annual turnover of less than 30 million yuan ($4.8 million).

The company has made it clear that its two main business arms will be e-commerce and financial services based on its huge e-commerce data. The latter is thought to be a challenge to banks and may change the financial industry landscape due to the use of Internet technology and the huge amount of data that records users' history and habits.

"For the past 13 years, Alibaba hasn't thought of challenging anyone, but creating something new instead," Alibaba's Chairman Jack Ma said at an industry forum late March when asked whether his company aims to challenge banks.

"Banks are getting a bit nervous. But I think that getting nervous is good, and it would be strange if they aren't," Ma said.

"If banks weren't nervous, China's small and micro businesses would be nervous," Ma added, hinting that banks fail to provide enough services to help small and micro enterprises raise funds.

Challenge to banks?

Major third-party payment companies in China first appeared around 2004, and they have quickly risen to prominence as the country's e-commerce market grew dramatically over the last decade.

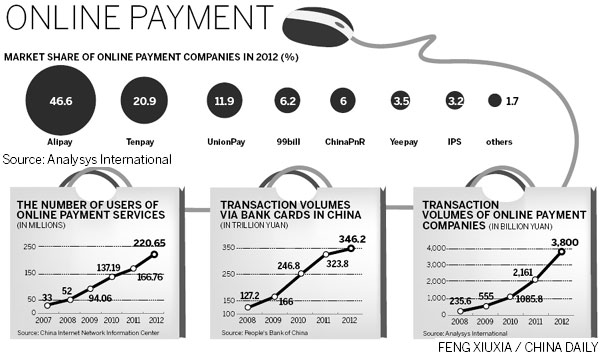

Last year, the total transaction volume processed by third-party payment companies reached 3.8 trillion yuan, an increase of 76 percent year-on-year, according to domestic research company Analysts International.

By contrast, in 2012, the total transaction volume of bank cards in China was 346.2 trillion yuan, according to People's Bank of China.

While the biggest player in the sector, Alipay, which is owned by Alibaba, originally acted only as an escrow between sellers and buyers, third-party payment companies are now offering a wide range of services, such as payment and settlement services, and micro loans.

Alibaba plans to launch a credit payment service for its mobile users, which gives them a certain credit limit based on their Alipay records.