|

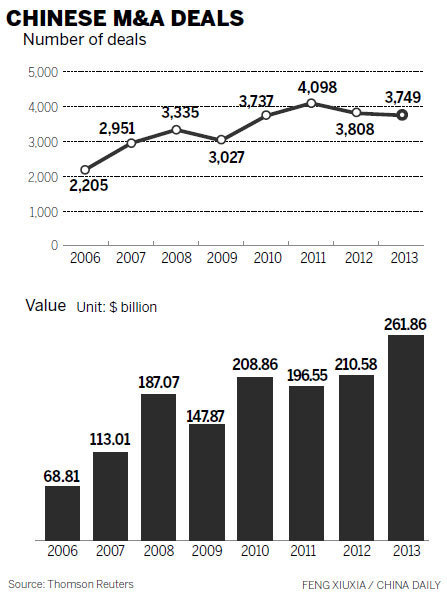

The value of deals announced in the Chinese mergers and acquisition market reached a record high in 2013. The restructuring of State-owned enterprises and initial public offering resumption will help its development in 2014, reports said.

A report by Thomson Reuters said that Chinese M&A deals in 2013 totaled $261.9 billion, with energy and power being the most popular sectors. By value, these sectors comprised 17.8 percent of all deals.

The report said that last year, the investment amount of cross-border M&As was $96.4 billion, the highest total in the past five years.

The investment amount of outbound M&A deals came to $61.9 billion, increasing 8.8 percent year-on-year, which also was the highest total since 2009.

The United States was the preferred destination for Chinese outbound M&A deals, totaling $12.2 billion in 2013, an increase of 96.6 percent year-on-year.

The $7 billion acquisition of Smithfield Food Inc by Shuanghui International Holdings Ltd (recently renamed WH Group Ltd) was the main reason for the increase, Thomson Reuters said.

The value of outbound M&A deals in the mining sector totaled $2.4 billion, with Australia, South Africa and Canada being the primary destinations, according to a report co-released by China Economic Weekly and the China Mining Association at the China Economic Forum.

The forum's report said Chinese companies should seek opportunities from foreign listed mining companies to make M&A deals smoother and quicker.

The investment amount of inbound M&A deals totaled $34.5 billion in 2013, a decrease of 8.1 percent year on year.

With a market share of 24.7 percent, the real estate sector was the most popular.

M&A deals reached a historic high domestically on Dec 24, when the deal value released was $162.9 billion, a 41.7 percent rise compared with the year before.

According to a report from ChinaVenture Group, the restructuring of State-owned enterprises should bring several merger-and-acquisition deals this year.

State-owned enterprises are picking up the pace of restructuring following the Third Plenary Session of the 18th Central Committee of the Communist Party of China last year.

The cities of Shanghai, Shenzhen, Chongqing, and Wuxi, and the provinces of Anhui and Shandong, have released detailed rules for SOE reform, which encourage foreign funds and private capital to participate through equity investment.

"As an important part of the Chinese economy, State-owned enterprises' reform will play an important role in the Chinese capital market. Many deals with large investment amounts will be made in the Chinese M&A market," said Wan Ge, a senior analyst at ChinaVenture Group.

ChinaVenture Group's report also said that IPO resumption will allow companies listed in 2014 to receive funding, much of which will be used for mergers and acquisitions.