Stocks finish mixed with higher volatility

By Li Zengxin (chinadaily.com.cn)

Updated: 2007-08-28 16:29

Updated: 2007-08-28 16:29

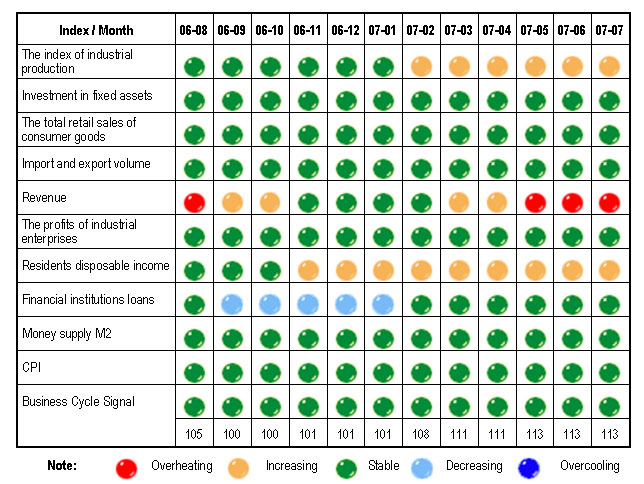

The red-hot stock market partly reflects China's overheated economy, said economists. The National Bureau of Statistics said the macroeconomic climate index in July was 113.3 points, the same as the previous month and close to the "alert" line, indicating that the Chinese economy is moving toward the "heated" zone. At the same time the fiscal revenue indicator has been in the red area for three consecutive months, said the bureau.

Monitoring Signals of Macroeconomic Climate Index

Source: National Bureau of Statistics

Stocks over the 5,000-point highs need a price adjustment period before climbing up further, many industrial experts believe. Some government measures to release steam and guarantee a "smooth" transition are already on the way, they said. Such measures include the expansion of capital outflow channels, by initial public offerings of large cap companies including China Construction Bank and China Shenhua Energy, and a diversion of capital inflow to peripheral markets.

From the capital inflow perspective, sources said that the third batch of the special treasury bonds will be issued tomorrow. The Agricultural Bank of China will buy 600 billion yuan worth special bonds and then directly sell 200 billion yuan of them to the market. However, the exact timetable for the sale to the market is still unknown.

On the other hand, analysts expect the government's move to allow mainlanders to invest directly in the Hong Kong market will have a "moderately negative" impact on A shares.

"The impact of this new policy on the A-share market will be moderately negative. Fund outflows under this new individual investment program will help ease excess liquidity and demand for financial assets," said Wang Qing, chief China economist at Morgan Stanley Asia Ltd.

"Some investors will likely choose to liquidate their holdings of A-share stocks to invest in H shares or other stocks on the Hong Kong market. "But since the forex outflows under this new program are unlikely to be large enough to offset forex inflows stemming from trade surpluses, the strong A-share market performance is unlikely to change due to excess liquidity," he said.

Besides large companies issuing A shares in the domestic market, the Chinese stock markets may welcome listings from overseas firms in the longer term.

Tu Guangshao, vice chairman of the China Securities Regulatory Commission, said the mainland market is gearing up for overseas companies to list in the local bourses. The domestic market is accumulating necessary experience, regulatory improvement and structural upgrade for overseas firms, mainly those from Hong Kong, to issue shares on the mainland in an "A+H" style. But the pace for the open-up will be gradual, Tu added.

|

|