Stocks fall 2.2% on tightening measures

By Li Zengxin (chinadaily.com.cn)

Updated: 2007-09-07 16:57

Updated: 2007-09-07 16:57

The Chinese stock market tumbled today in response to a set of tightening measures by the central bank to reduce money supply and curb excessive liquidity. The Shanghai Composite Index dropped 116.48 points or 2.16 percent, the largest single-day fall since August 1 in absolute terms.

Turnover of the stocks in the major indices was 286.8 billion yuan, higher than yesterday.

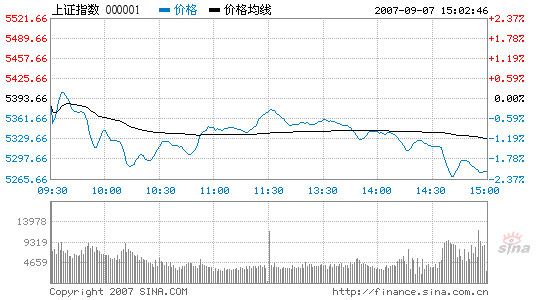

Shanghai Composite Index

Source: sina.com.cn

The Shanghai index opened slightly lower at 5,381.19, climbed up to 5,405.36, the highest for the day for the only trading period above yesterday's close, but then fell to 100 points lower than the opening. Once there it turned up and hit the second highest place before the noon break. In the afternoon, the index slid again to the lowest at 5,269.25 soon before the close. Finally, it finished the day at 5,277.18.

Of the A shares listed in Shanghai, as many as 609 closed down, 75 ended flat but 158 went up against the trend, including 16 of them rising at the 10 percent growth cap. The Industrial and Commercial Bank of China, with the largest trading volume, fell 2 percent and CITIC Securities, with the largest transaction value, dropped over 4 percent.

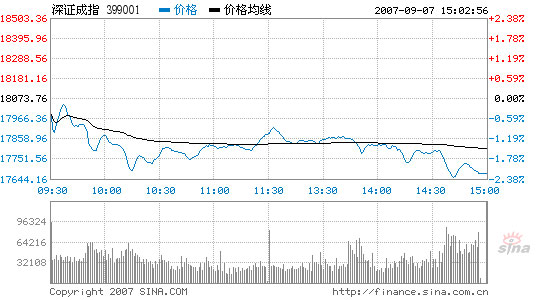

Shenzhen Component Index

Source: sina.com.cn

The Shenzhen Component Index, tracking the smaller Shenzhen Stock Exchange, opened lower at 17,986.88 and closed 399.66 points or 2.21 percent lower at 17,674.10. It went through the whole day below yesterday's close, within a range between 17,649.09 and 18,052.37.

Of the A shares, 132 closed up, 71 remained unchanged and 436 fell. Large traders TCL and China Vanke were both down.

Stocks in the culture and media, timber and machinery industries were more resistant to depressing forces. On the other hand, financial shares lost ground today as all of them except Huaxia Bank and Bank of Nanjing slipped, dragging down the indices.

The central bank yesterday announced two tightening measures to rein in excessive liquidity. China will raise the reserve requirement ratio by 0.5 percentage points for commercial banks as of September 25. It is the seventh time this year the Chinese government has opted to raise the reserve requirement ratio.

|

||

|

|