Outward bound for Chinese investors

Updated: 2007-10-22 11:05

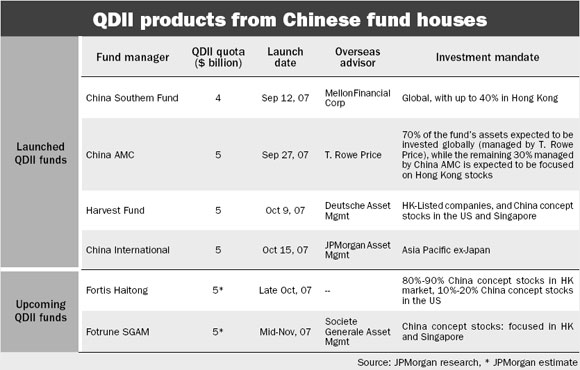

China International Fund Management - a joint venture between JPMorgan Asset Management and Shanghai International Trust and Investment (SITICO) - raised the targeted US$4 billion for its maiden qualified domestic institutional investor (QDII) fund, drawing more than 105 billon yuan (US$13.96 billion) in subscriptions on October 15, the first day of sales.

The fund will target Asia-Pacific stocks in Hong Kong, Australia, Singapore, India and South Korea, but exclude Japan, according to fund manager Yang Yifeng.

This is the fourth QDII fund launched in recent weeks by Chinese asset managers, following products from China Southern Fund Management, China AMC and Harvest Fund Management. The fund was more than three times oversubscribed and surpassed the previous QDII subscription record set by Harvest last week.

"To reiterate our estimates, we expect US$90 billion in QDII funds to leave China in the next year, with at least a third of it to be invested in Hong Kong's stock market," Jing Ulrich, managing director and Chairman of China Equities with JPMorgan Securities Co Ltd projects. QDII inflows have bolstered Hong Kong's market in recent weeks.

The upcoming throughput program, which allows individuals to invest directly in Hong Kong's stock market, could bring an estimated US$30 billon into the territory next year, Ulrich says. She estimates the free float of H shares and red chips to be US$345 billon yuan.

Two other fund houses - Fortis Haitong Investment Management and Fortune SGAM - are expected to introduce their first QDII products in the coming weeks.

"We are also hearing that some asset managers who had early QDII funds are now preparing their second productsbut it is not clear if they will have to wait until other firms have had their turn entering the QDII arena," Ulrich says.

Besides fund companies, securities firms including CITIC Securities and Guotai Junan Securities also received QDII licenses from the China Securities Regulatory Commission, joining China Merchants Securities and China International Capital Corp on the roster of securities firms approved under the QDII program.

|

||

|

|