Major stock index drops below 5,000 points again

By Li Zengxin (chinadaily.com.cn)

Updated: 2007-12-13 16:51

Updated: 2007-12-13 16:51

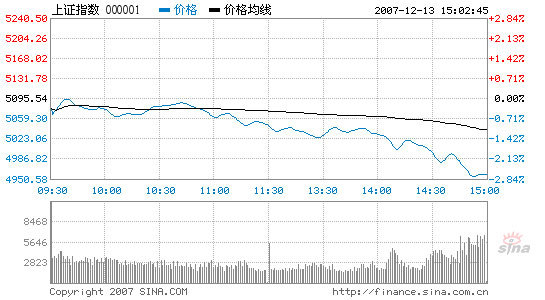

Shanghai Composite Index

Source: sina.com.cn

Chinese stocks continued sliding today on expectations of further tightening measures by the central bank. The benchmark Shanghai Composite Index dropped to 4,958.04, the fourth time in less a month it has dipped below the 5,000-point watershed.

PetroChina, the heaviest weighted stock in the Shanghai index, dropped 1.96 percent to close at 30.53 yuan, just above its historical low. China Shipping Container Lines fell 5.79 percent to 10.9 yuan on its second day of trading, making it one of the worst performers among all the new shares.

Banks and real estate developers, on a possible interest rate raise and restraint measures targeting the housing sector, led the plunge. All traded bank shares except Bank of Ningbo were down, so were most of the real estate companies, dragging down both the major indices.

Opening lower at 5,078.18, the Shanghai index spent the whole day below yesterday's closing level, hitting its high in the morning at 5,095.15. After a series of moderate swings, it lost momentum when trading resumed after the noon break, and closed 2.7 percent or 137.5 points down from yesterday's closing, and just a few points higher than the daily low of 4,954.36.

The Shenzhen Component Index opened lower at 16,711.45, stayed between 16,021.83 and 16,762.65, and stopped at 16,035.19, down 796.38 points or 4.73 percent. The largest trader, China Vanke, plummeted 5.22 percent along with the wave of diving property developers.

Of the 1,500-odd listed A shares, only 166 moved up and 151 ended flat, leaving the bulk of the rest in deep water. Analysts said today's overall slump could be a result of fear over lower profitability in sectors most likely to be hit by tightened monetary policy, and in particular the finance and property industries.

Central bank governor Zhou Xiaochuan said on the sidelines of the Third China-US Strategic Economic Dialogue (SED) held in Beijing yesterday that China is currently studying the option of another possible interest hike as its next move to further tighten monetary policy, but a combined policy pack may be needed to curb inflation.

He said surging domestic consumer prices and recent US interest rate cuts would have a "considerable influence" on Chinese monetary policy. The People's Bank of China would "seriously consider" the situation, he added.

|

||

|

|