Nation top draw for investors

Updated: 2007-12-28 09:45

China continued to lead in both funds raised and number of initial public offerings (IPOs) in the past 11 months, according to a report by auditor Ernst & Young.

The annual study found the nation raised $54.4 billion funds in the period, accounting for 21 percent of total funds raised globally. A total of 227 IPOs were launched by Chinese companies in the past 11 months, compared with 1,739 offers worldwide.

"The surge in IPO activity in China is a clear reflection of the growth in the Chinese economy and the confidence investors have about putting their money into China," said Conway Lee, partner and industry leader of Ernst & Young's retail and consumer products practice.

According to the report, global IPO activity hit a record high in 2007. The capital raised and the number of companies choosing to go public in the first 11 months exceeded those figures for all of 2006.

From January to November, $255 billion was raised globally through 1,739 IPOs - compared with $246 billion raised in 1,729 deals in the whole of 2006.

IPO activity in 2007 continued to be driven by emerging markets, which accounted for the majority of the largest deals of the year. The report said 14 of the top 20 IPOs were from emerging countries.

Brazil, Russia, India and China - the so-called BRIC countries - have raised $108.4 billion in 400 deals so far this year, compared with $89.6 billion raised in 302 deals in the same period of 2006.

"The increased activity across the emerging markets stems from the growth of their economies and the ongoing globalization of the capital markets. This has seen the rise of new world-class financial centers, investors looking further afield for investment opportunities, and the continuing trend of companies looking to list on domestic exchanges," said Joe Tsang, Ernst & Young's assurance leader for North China.

Tsang said almost all of the top 20 IPOs this year took place in the companies' home countries.

The mainland is expected to raise 330 billion yuan next year and Hong Kong HK$260 billion, according to the report.

"These amounts, which include funds raised in red-chip returns, are less than the 2007 actual amounts because many large SOEs have already listed in Hong Kong and Shanghai," Tsang said.

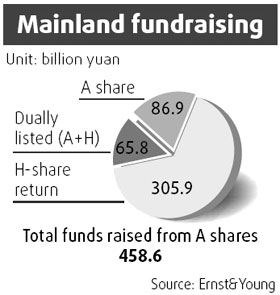

A significant share of the funds raised on the mainland this year are from returning H-share companies and dual A- and H-share listings by State-owned firms. Meanwhile, the majority of privately owned companies chose to list on the Hong Kong and overseas exchanges this year.

"We believe that red-chip returns will commence in 2008, there will continue to be privately owned enterprises listed on the Hong Kong and overseas exchanges, and there will also be foreign-invested enterprises listing in Hong Kong and on the mainland," Tsang said.

|

|