Morgan Stanley to offload CICC

Updated: 2008-01-08 07:21

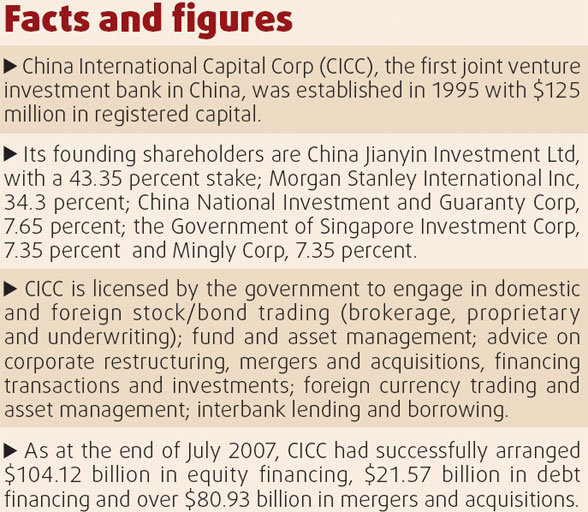

US financial services firm Morgan Stanley plans to sell its entire stake in China International Capital Corp (CICC), the nation's first investment bank, sources close to the two companies said yesterday.

Morgan Stanley currently holds a 34.4 percent stake in CICC, but with a limited role in the investment bank. The sources said the US firm might sell its entire stake in CICC and invest in another local brokerage.

Earlier in December, local media reported that the global financial services firm was planning to buy a 33.5 percent stake in Shanghai-based China Fortune Securities for 4 billion yuan.

The reports said Morgan Stanley had signed an agreement with China Fortune Securities to set up a joint venture investment bank and that Morgan Stanley might be interested in a controlling stake.

But under new rules issued by the China Securities Regulatory Commission (CSRC) on December 28, the maximum stake foreign investors can hold in a local securities firm will remain at around 33.3 percent, despite lower barriers in other areas.

China Fortune Securities ranks 48th among 104 brokerages, with registered capital of 1 billion yuan by the end of 2006, according to the CSRC.

The CSRC's new rules issued on December 28 also require 1.2 billion yuan in net capital in the last year for a securities firm if it wants to set up a subsidiary.

"To meet the requirement, Morgan Stanley and China Fortune might increase their net capital before they set up a joint venture investment bank," said Liang Jing, an analyst with Guotai Jun'an Securities. "The new rule may not be a big problem for Morgan Stanley and China Fortune."

Morgan Stanley is expected to become one of the first foreign firms to invest in a local securities firm in 2008, after the government resumed approvals of foreign joint ventures based on the China-US Strategic Economic Dialogue.

The government banned international companies from investing in local securities firms in October 2006, concerned that it would threaten local brokerages recovering from a four-year slump. Before the ban, UBS and Goldman Sachs Group Inc were the only foreign firms with brokerages in the country.

China's securities industry scored big money last year thanks to the bullish stock market. By June 2007, 24 leading brokerages had made a total net profit of 37.9 billion yuan, a year-on-year increase of 425 percent.

Shanghai-listed CITIC Securities yesterday predicted fivefold net profit growth for 2007 compared with 2006. The company posted a net profit of 2.4 billion yuan in 2006.

|

|