HK stocks dive on fear of slowdown

Updated: 2008-01-17 08:59

Hong Kong shares joined global plunges yesterday to tumble more than 5 percent - the largest percentage drop since the September 11 terror attacks - on growing speculation the US economy is sliding into a recession that could lead to a global slowdown.

Investors dumped stocks after an overnight sell-off on Wall Street and on news that Citigroup Inc had lost nearly $10 billion in the fourth quarter as it wrote down mountains of bad mortgage assets - the latest fallout from the credit crisis. Weak US retail sales figures added to the gloom.

Investors dumped stocks after an overnight sell-off on Wall Street and on news that Citigroup Inc had lost nearly $10 billion in the fourth quarter as it wrote down mountains of bad mortgage assets - the latest fallout from the credit crisis. Weak US retail sales figures added to the gloom.

"American financial mismanagement has brought us to this economic meltdown," said Francis Lun, a general manager at Fulbright Securities in Hong Kong. "Asian stock markets are all suffering; nobody has escaped."

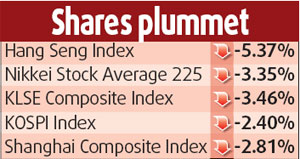

The benchmark Hang Seng index sank 1387 points, or 5.4 percent, to 24,450.85, a four-month low. Tokyo's Nikkei 225 index fell 3.4 percent to 13,504.51 points, its lowest in more than two years.

Markets in the Chinese mainland, Australia, India, South Korea, New Zealand and the Philippines also dropped sharply on uncertainty about the US economic outlook and the full extent of the subprime mortgage crisis.

In Shanghai, the A-share market slid 2.8 percent, and the smaller Shenzhen market dropped 3.6 percent

In Europe, where markets had fallen sharply Tuesday, stocks slid again. Britain's FTSE 100 and Germany's DAX were both down more than 1 percent in morning trading.

Dow Jones Industrial Average, NASDAQ and Standard &Poor 500, all skidded by more than 2 percent on Monday.

One of the biggest losers on the Hong Kong bourse yesterday was HSBC Holdings, known to hold a significant amount of subprime home loans, which dived 4.8 percent. Analysts expect HSBC will continue to suffer in the coming months.

"Until HSBC announces its results, the subprime fears will cloud its performance as investors remain cautious about its profits," Delta Asia securities head of research Conita Hung Lai-Ping said.

Blue chips like Hong Kong Stock Exchange and Clearings and China Mobile also fell by 6.98 percent and 5.05 percent respectively.

The H-share index - the gauge of mainland companies listed in Hong Kong - tanked 6.6 percent with mainland commercial banks leading the downward spiral. Bank of China (Hong Kong), another bank with subprime assets, plummeted 9.11 percent.

"The investment atmosphere is really bad at the moment," CASH asset management associated director Patrick Yiu said.

"I expect the selling streak to linger for the rest of the week as investors anticipate more bad news to surface," he said.

He said various US financial institutions troubled by subprime mortgages, like Morgan Stanley and Merrill Lynch, are expected to announce mediocre results this week, to further dampen investor sentiments.

However, he expects the market to stabilize next week.

The expectation of a large US interest rate cut by the end of the month will provide a boost to the local market, Hung said.

"But until then, we can expect the market to be more volatile and may hit a low of 23,400. This may be a good time for bargain hunting."

Agencies contributed to the story

|

|