Major index breaks 4,000-point psychological mark

By Ding Qi (chinadaily.com.cn)

Updated: 2008-03-13 16:29

Updated: 2008-03-13 16:29

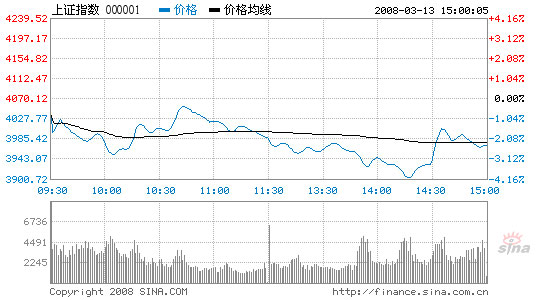

The benchmark Shanghai Composite Index slid below the landmark 4,000-point level Thursday amid panic selling and investors' waning confidence in the market.

Shanghai Composite Index

Source: sina.com.cn

Following yesterday's dive, the Shanghai index opened 37 points lower today and broke 4,000 points just after the start of trading. It slumped further to the day's lowest of 3,902.25 points in the afternoon session before a slight recovery in the last half hour. The market closed at 3,971.26 points, down 2.43 percent, failing to recover the 4,000-point level.

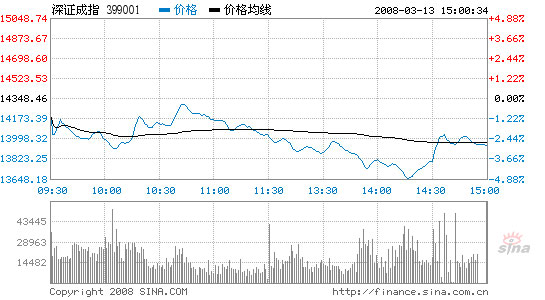

The Shenzhen Component Index lost even more to close at 13,943.16 points, dropping 2.82 percent. The HSI 300 index, covering major stocks of both markets, fell 110 points, or 2.57 percent.

Turnover of the two markets totaled 142.03 billion yuan (US$20.01 billion), a bit larger than yesterday's due to panic selling in the afternoon.

Losers far outnumbered gainers today by 1,247 to 67. Twenty-one stocks dropped by a daily limit of 10 percent, while only 20 stocks rose more than five percent.

Shenzhen Component Index

Source: sina.com.cn

The energy sector was among the few industries surviving today's sell-off. Shenhua Energy led the sector with a four-percent rise. Oriental Energy, a small-and-medium board firm focusing on LNG processing, surged ten percent and became one of the top three gainers today.

Other blue chips remained weak. PetroChina went down 1.86 percent and closed at a fresh low of 21.65 yuan. Shanghai International Airport lost another nine percent following yesterday's maximum daily drop as investors feared a change in airport service charges could greatly affect the firm's profit.

Ping An Insurance declined only 0.66 percent despite losing more than one third of the mainland market value since it declared a huge share sale plan. A recent report from a Belgian newspaper said that the insurer is in talks with Fortis over the purchase of a stake in the Belgian-Dutch financial services group's fund management unit.

The central bank reported yesterday that outstanding renminbi deposits among domestic financial institutions reached 40.49 trillion yuan in February, up 17.22 percent year-on-year. The figure suggests an initial effect from the tightening monetary policy and more "cautious" money flowing back to the banks.

A recent study by China International Capital Corp (CICC) predicted that the central bank will raise the interest rate again within this month following February's record CPI growth of 8.7 percent. A continued fear of more tightening measures also weakened enthusiasm in the capital market.

|

|