|

BIZCHINA> Top Biz News

|

|

Related

China Life plunges after Q1 profit declines

(China Daily)

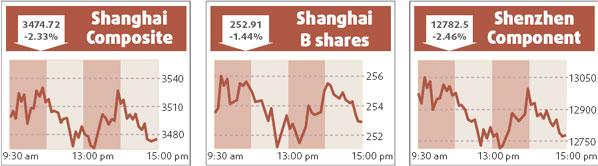

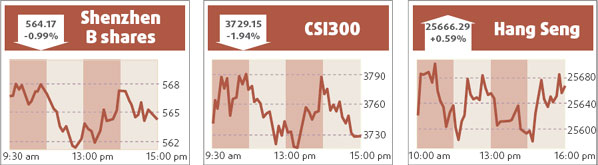

Updated: 2008-04-29 09:44   China Life Insurance Co, the nation's largest insurer, fell in Shanghai trading after the company reported a drop in first-quarter profit as a declining domestic stock market hurt investment returns. The Beijing-based insurer lost 4.12 percent to 32.8 yuan ($4.68) on the Shanghai market yesterday. Its Hong Kong-traded shares slid 1.63 percent to HK$33.25 ($4.27). China Life's net investment income declined 10 percent to 15.1 billion yuan in the first quarter as the nation's benchmark stock index lost 29 percent, making its market the world's seventh worst performer. The firm's 39.5 percent first-quarter premium growth also left it lagging a 52 percent average for the country's life insurance industry. "We've sold China Life shares as we lower our China exposure and face redemptions in the market downturn," said Gabriel Gondard, deputy chief investment officer at Fortune SGAM Fund Management Co. "What's key for investors is China's stock market performance, given its link to insurers' investment returns." Fortune SGAM sold 8 million China Life shares by the end of December. China Life's first-quarter net income fell 61 percent to 3.47 billion yuan, or 0.12 yuan a share, from 8.89 billion yuan, or 0.31 yuan a share, the firm said in a statement late Sunday.

The company had 23 percent of its 2007 portfolio invested in equities, compared with 24.7 percent for smaller rival Ping An Insurance (Group) Co. Shenzhen-based Ping An, China's second biggest insurance firm, is scheduled to announce first-quarter earnings on Wednesday. "Equities are actually not a large part of Chinese insurers' portfolios, but they ended up taking a disproportionate role in companies' reported earnings because the market was so heated last year, according to Howard Wang, the Hong Kong-based head of Greater China at JF Asset Management. Chinese insurers are well-equipped to manage their equity investments, though short-term headline profits and investor sentiment will be negatively affected by the market slump, wrote Hong Kong-based Credit Suisse Group analysts Chris Esson and Frances Feng in an April 17 report. Esson and Feng, who have an "outperform" rating on China Life's stock, said they prefer the company to Ping An because the former's equity portfolio provides greater profit-smoothing flexibility. China Life's acquisitions strategy is also not as rife with uncertainty as Ping An's, according to Credit Suisse. China Life's Shanghai-traded stock has plummeted 43 percent this year. (For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 宣化县| 英德市| 长岛县| 菏泽市| 永昌县| 衢州市| 五莲县| 临沂市| 孟村| 临夏市| 公安县| 武乡县| 福贡县| 岢岚县| 万盛区| 宁都县| 宜良县| 雷山县| 商都县| 泸西县| 上思县| 赤水市| 蓬莱市| 安丘市| 凤台县| 长治市| 清镇市| 通州市| 华坪县| 乌兰县| 扶余县| 泉州市| 建宁县| 江西省| 汕头市| 孝义市| 遵化市| 托克逊县| 调兵山市| 萍乡市| 英吉沙县| 恩施市| 尤溪县| 辽中县| 乡城县| 布尔津县| 方城县| 齐齐哈尔市| 徐水县| 五台县| 敦化市| 通渭县| 文化| 洪洞县| 会泽县| 宜昌市| 旌德县| 宽城| 洛川县| 邓州市| 朝阳区| 汉寿县| 五莲县| 巩义市| 松原市| 青浦区| 普陀区| 安平县| 江源县| 哈尔滨市| 吴江市| 乐业县| 新安县| 屏南县| 通辽市| 措美县| 抚顺县| 内乡县| 英德市| 浦北县| 彭山县| 东兰县|