|

BIZCHINA> Center

|

|

US treasury bonds 'still the best option'

By Xin Zhiming (China Daily)

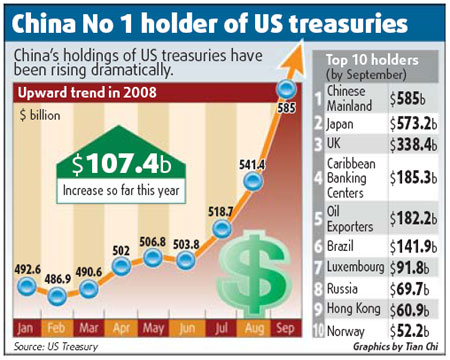

Updated: 2008-11-20 09:46 China is likely to continue increasing holdings of US treasury bonds even after becoming the No 1 holder because it is the best way to deploy its $1.9 trillion foreign exchange reserves, economists say. On Monday, US Treasury data showed that China had replaced Japan to become the top holder of US treasury debt in September.

With a $43.6 billion increase in holdings of US treasury securities in September, China's overall holdings amounted to $585 billion. Japan cut its holdings to $573 billion from $586 billion in August. Net foreign purchases of long-term US securities totaled $66.2 billion in September, up from $21 billion in August and $18.4 billion in July. Treasury data suggests that foreign investors still regard the US as a relatively better place to invest when markets worldwide are crumbling, analysts said. "That's why China has increased its holdings," said Dong Yuping, senior economist at the Institute of Finance and Banking affiliated to the Chinese Academy of Social Sciences. As the US financial crisis worsens, Washington is in dire need of capital to fund its massive market rescue plan; but some domestic economists argue that China should not use its foreign exchange reserves to purchase US bonds for fear that it may incur huge losses.

"But China may not have many options," Dong said. The US economy, though hemorrhaging from the crisis, remains the largest and strongest; and the EU and Japan are not yet a serious challenge to US pre-eminence. Investment in dollar assets, therefore, carries the least risk, he said.

"China and the US are in the same boat," he said. "You may not like it, but China has to move along this path," said Yan Qifa, senior economist with the Export-Import Bank of China. And now that many countries are increasing holdings of US treasury bonds, China's potential returns from the bonds will increase, said Chen Gong, chief economist and chairman of Anbound Group, a Beijing-based consulting firm. "So China may continue to increase its holdings," he said. However, some experts argue that Beijing use its considerable financial leverage to set conditions such as the US opening its financial markets more to Chinese funds, and allowing exports of high-tech products to China. (For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 栖霞市| 沅江市| 翼城县| 马公市| 历史| 云阳县| 凯里市| 长春市| 阳原县| 盐亭县| 囊谦县| 米泉市| 阿合奇县| 法库县| 衢州市| 勃利县| 楚雄市| 新津县| 焉耆| 哈密市| 环江| 紫云| 新郑市| 铁岭县| 孝昌县| 裕民县| 驻马店市| 长治市| 茂名市| 永宁县| 大同市| 长兴县| 海伦市| 拜泉县| 康乐县| 水富县| 临猗县| 贡山| 南宁市| 宜章县| 施秉县| 菏泽市| 清镇市| 武功县| 吉木萨尔县| 永登县| 综艺| 新沂市| 建宁县| 龙里县| 双流县| 宣化县| 庄浪县| 房山区| 孝昌县| 武胜县| 德阳市| 梨树县| 永和县| 进贤县| 凉山| 河源市| 措美县| 靖宇县| 宿迁市| 临泉县| 获嘉县| 延安市| 邵东县| 南阳市| 宁波市| 金塔县| 浏阳市| 陇南市| 新津县| 彭阳县| 五莲县| 改则县| 榆社县| 新民市| 兴安盟| 西青区|