|

BIZCHINA> Top Biz News

|

|

Airlines come down to earth as recession bites

By Lu Haoting (China Daily)

Updated: 2008-12-12 07:57

The old Chinese saying, "leaking houses are exposed to night-long pouring rain," may well describe the gloom in the Chinese airline industry.

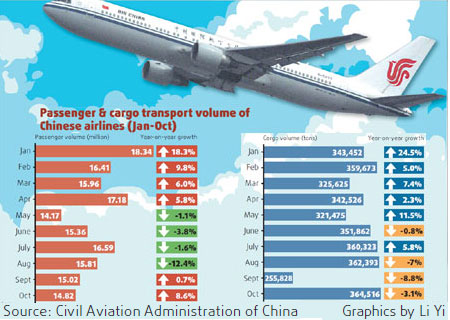

The deteriorating conditions have led to a slump in freight transportation and also forced people to cut back on air travel. Chinese airlines booked a combined net loss of about 4.2 billion yuan in the last 10 months, said Liu Shaocheng, director of the policy and research center of the Civil Aviation Administration of China at a recent industry forum. The industry was also hit by additional challenges like the snowstorm at the beginning of the year, the earthquake in Sichuan province and the high inflation, all of which have impacted traffic. "The Chinese airline industry will continue to be in the red next year, due to falling demand and reduced pace of renminbi appreciation," said Zhang Qi, an aviation analyst with Orient Securities. Foreign exchange gains were a major source of profit for Chinese airlines in the early part of the year. The appreciation of the renminbi, to a large extent, offset the surging fuel costs because a large chunk of Chinese airlines' borrowing is in foreign currency. The renminbi appreciated by about 6 percent against the US dollar in the first six months of the year. The previously buoyant airline industry in the country started showing a negative growth in passenger and cargo transportation from June, the first time since the 2003 SARS epidemic. The fall continued in the following months also. "The market is expecting the renminbi to appreciate by only 2-3 percent next year. There is even a possibility of depreciation due to the economic slowdown. The problems and difficulties of Chinese airlines will be completely exposed," Zhang said. The International Air Transport Association (IATA) recently said global air traffic declined for a second consecutive month in October. International passenger traffic fell 1.3 percent over the same period last year, while in September the fall was 2.9 percent. International air cargo hit its worst patch since 2001 in October this year as traffic declined by 7.9 percent for the fifth consecutive month. "While the drop in oil prices is a welcome relief, recession is now the biggest threat to airline profitability. The deepening slump in cargo markets is a clear indication that the worst is yet to come," said Giovanni Bisignani, director general and CEO, IATA. The IATA estimates the industry to lose $5 billion in 2008 and $2.5 billion in 2009. "The outlook is bleak. We are facing the worst revenue environment in the last 50 years," Bisignani said. Finding solutions Desperate to increase load factors, domestic airlines have now started wooing passengers with aggressive price cuts. For example, ticket prices on popular routes, like the Beijing-Shanghai route, are 55 percent lesser on online travel portals like Ctrip.com and eLong.com. For many other routes prices have been cut nearly 75 percent. "In the past we had only about 10-15 percent of the seats on one flight sold for a special price of 99 yuan. But now we are increasing this to 30-40 percent of the total seats to maintain our load factor," said Zhang Lei, spokesman of Spring Airlines, a Shanghai-based private low-cost carrier. Although the airline has not seen big drops in load factor, the price cuts have resulted in profits falling nearly 70 percent, Zhang said. State-owned airlines are also seeking government cash injection to rectify the high debt-to-asset ratios. Parent companies of China Southern Airlines and China Eastern Airlines recently, respectively, received a 3 billion yuan infusion from the government. The two airlines will issue both A shares and H shares to their parents to obtain the funds. That is the first time over the past five years for the government to directly inject cash into airlines. Shares of the two carriers surged on the news yesterday. In Shanghai trading, China Southern and China Eastern both jumped 9.9 percent. Their Hong Kong-listed H shares rose 44 percent and 42.7 percent respectively. Air China, the nation's flag carrier, is reportedly waiting for a 10 billion yuan injection from the government. Hainan Airlines is also seeking cash injection from the local government. "The cash injection is not likely to create a drastic change in airlines' businesses or pull them back to the black. It could only temporarily improve their debt-to-asset ratio," said Yu Jianjun, an analyst with Huatai Securities. The debt-to-asset ratio of China Southern, the country's largest airline by fleet numbers, exceeded 83 percent by the end of the third quarter. The cash injection is expected to lower the ratio by 2.5 percentage points, analysts said. China Eastern's debt-to-asset ratio is even higher at 98.5 percent and the ratio could be lowered to 94.7 percent with the infusion, Yu said. "The ultimate factor that affects businesses is still traffic demand," Zhang said. "There might be some improvement next year given the government's massive stimulus packages, which would spur economic activities," Zhang said. The State Council recently announced plans to invest heavily on a wide array of national infrastructure and social welfare projects. These projects are expected to trigger an overall investment of up to 4 trillion yuan until 2010. (For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 额尔古纳市| 开平市| 房山区| 黄浦区| 越西县| 承德市| 贵南县| 九寨沟县| 麻阳| 汕头市| 左云县| 内乡县| 吴川市| 阿拉善左旗| 长汀县| 禹城市| 杭州市| 荥阳市| 玉溪市| 松潘县| 浦城县| 托里县| 哈尔滨市| 沙湾县| 涟水县| 阳朔县| 通州区| 伊川县| 大冶市| 池州市| 墨玉县| 淮南市| 建始县| 荆州市| 岗巴县| 临潭县| 九龙县| 荆门市| 潞城市| 武威市| 霍城县| 贞丰县| 安远县| 丹寨县| 资阳市| 长武县| 永新县| 洪雅县| 昂仁县| 扎鲁特旗| 和平区| 泸水县| 宜章县| 正阳县| 涞水县| 洮南市| 涿鹿县| 洪湖市| 余庆县| 遂川县| 互助| 平谷区| 化州市| 长顺县| 蒙自县| 新巴尔虎左旗| 宁强县| 沈阳市| 平山县| 吐鲁番市| 油尖旺区| 井研县| 永兴县| 文成县| 称多县| 清新县| 彭阳县| 嘉荫县| 会昌县| 栾川县| 翼城县| 鄱阳县|