|

BIZCHINA> Top Biz News

|

|

Mergers losing steam in China

By Hu Yuanyuan (China Daily)

Updated: 2008-12-17 08:08

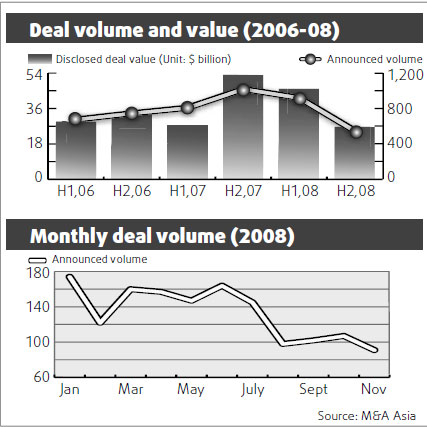

Only 543 M&A deals have been announced in this period despite a 14 percent growth in the first six months, when over 920 deals worth $46 billion were transacted. The accounting firm said it expects the overall M&A activity in China to remain slow in the first half of 2009 before a pick-up in the second half as pricing expectations align. "M&A deals fell dramatically in the second half of 2008, on compounding domestic issues and the global economic crunch," said Xie Tao, PricewaterhouseCoopers Transactions Partner in Beijing. Domestic factors like regulatory policies to deal with high inflation, interest rate hikes, development of new labor laws, increasing commodity prices, and the plummeting stock market affected sentiment. This was followed by the effects of the global economic crisis hitting China, Xie said. Despite the drop in activity, manufacturing remains the most active sector by number of deals, while real estate is the biggest sector by deal value, said the report. Outbound deal volume fell 29 percent in the second half of the year, with only 32 transactions. "Chinese companies still have money and government support to invest abroad and are now simply putting their activities on hold until the overall global economic conditions become less volatile," said Xie. "Interest from Chinese companies in overseas acquisitions remains high, and more deals should be executed sometime in 2009," he said. Xie said he believed that the general economic conditions would gradually improve in China, as it is likely to recover faster than the rest of the world. As in the previous couple of years, the main industries for Chinese acquisitions abroad were still mining and financial services, with 22 and 9 deals transacted in 2008. Deals were also clinched in hi-tech industries like medical equipment, hardware, software and biotechnology. "This reflects the increased level of maturity of the Chinese economy and shifting of China's focus to other industries that can add value to the country's economic growth," said Xie. Strategic buyers are currently waiting for conditions to improve, and are likely to execute deals in the second half of 2009, said Xie. While planning their acquisitions, buyers are also waiting to see whether things turn around and are looking to preserve cash to manage their existing operations through the economic downturn. Private equity buyers with cash for acquisitions will have buying opportunities as valuations decrease and alternative sources of capital dry up. But with sellers reluctant to sell in a declining market, there could be a "valuation gap" that needs to narrow before PE activity can pick up again, said Xie.

(For more biz stories, please visit Industries)

|

||||

主站蜘蛛池模板: 汉沽区| 大安市| 侯马市| 合江县| 临洮县| 灵川县| 凉山| 夏邑县| 郯城县| 梁山县| 钟山县| 乌兰察布市| 民勤县| 黔东| 绵竹市| 翼城县| 麻栗坡县| 霍林郭勒市| 富宁县| 镇江市| 贡觉县| 普格县| 西乌| 出国| 静乐县| 金昌市| 盐边县| 当涂县| 甘肃省| 通城县| 黑龙江省| 华坪县| 盐山县| 二连浩特市| 瓮安县| 璧山县| 新疆| 鹰潭市| 彭阳县| 象山县| 罗源县| 山西省| 福州市| 额济纳旗| 鹤岗市| 荆门市| 淳安县| 织金县| 会理县| 修水县| 泾川县| 运城市| 富顺县| 友谊县| 洪泽县| 竹溪县| 筠连县| 银川市| 独山县| 灌云县| 阿拉善左旗| 沁水县| 开封市| 大埔县| 鸡东县| 什邡市| 萨嘎县| 凤山市| 五家渠市| 湘阴县| 克拉玛依市| 淮北市| 汝城县| 桂林市| 蒙阴县| 辽宁省| 乌什县| 崇信县| 苍梧县| 营口市| 遂溪县| 紫金县|