|

BIZCHINA> Top Biz News

|

|

Final touches for deposit insurance

By Hu Yuanyuan (China Daily)

Updated: 2008-12-19 08:00

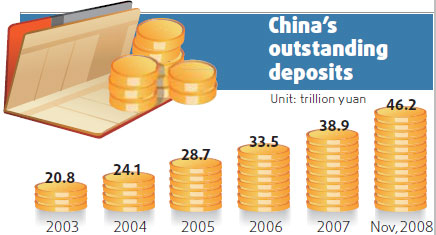

"The plan will be passed next year at the latest," he said. Central bank statistics show that total bank deposits amounted to 46.2 trillion yuan at the end of November, up 19.94 percent from a year earlier. Although it is generally understood that the central government will stand behind any bank, there had been runs on a few small banks in Hainan and Guangdong provinces in the past few years. These minor incidents subsided quickly, but there are obviously lingering worries in the minds of many depositors as the global financial crisis continues to worsen. "There is no sign of irregular cash withdrawals on the mainland, but it's quite necessary to strengthen people's confidence in the financial system," said Sun Minjie, executive vice-president of Bank of East Asia's mainland subsidiary.

"The long-awaited deposit insurance scheme on the mainland needs to be established soon." The central bank has been studying ways to shield depositors against risks arising from bankruptcy of financial institutions for about 10 years. In April 2004, the central bank set up a deposit insurance division at its financial security bureau. Last year, the Chinese central bank signed a Memorandum of Understanding with the US Federal Deposit Insurance Co on cooperation in deposit insurance. "The launch of the deposit insurance system, on one hand, could boost people's confidence, especially at such trying times," said Zhu Junsheng, an insurance researcher with the Capital University of Economics and Business. "It can also allow badly managed banks to go out of business without requiring the government to pick up the bill," Zhu added. According to Zhang of the central bank, all the deposit-taking financial institutions must take part in the proposal, which would cover 98 percent of all deposit accounts. "But the most urgent task is to find ways to cover the losses of those rural cooperatives destroyed in the Wenchuan earthquake," said Zhang. A recent survey by the central bank shows that over 98 percent of deposit accounts have balances of below 200,000 yuan each, which could be the ceiling set by the proposal. The United States was the first country to establish an official deposit insurance system during the Great Depression in 1934. Since then, nearly 100 other countries have introduced similar plans to protect depositors.

(For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 新闻| 河池市| 岑巩县| 安图县| 白水县| 托克托县| 惠来县| 突泉县| 永胜县| 博白县| 汝阳县| 会泽县| 太白县| 仲巴县| 清远市| 西充县| 中西区| 延庆县| 镇宁| 新民市| 东安县| 南雄市| 南平市| 延边| 连州市| 伊川县| 特克斯县| 逊克县| 宁陵县| 新化县| 山东| 白河县| 盐津县| 大冶市| 淮滨县| 湘潭县| 尖扎县| 望谟县| 武夷山市| 天气| 祁东县| 墨竹工卡县| 抚宁县| 茶陵县| 青神县| 麦盖提县| 托克逊县| 高淳县| 贡嘎县| 综艺| 威海市| 土默特左旗| 大连市| 黔西| 新建县| 六枝特区| 兰考县| 华蓥市| 西乌珠穆沁旗| 山丹县| 通辽市| 万宁市| 陇西县| 吴桥县| 土默特右旗| 开阳县| 平远县| 汉川市| 虞城县| 三明市| 清丰县| 颍上县| 香河县| 壤塘县| 文登市| 刚察县| 山西省| 汉川市| 弋阳县| 方山县| 东乌| 佛山市|