|

BIZCHINA> Top Biz News

|

|

Related

HSBC to raise new capital, cut jobs

By Kwong Man-ki and Joey Kwok (China Daily)

Updated: 2009-03-03 08:06

HSBC Holdings yesterday said it would raise a total of $17.7 billion in new capital from shareholders in a rights issue to strengthen its financial structure after reporting a more than 50 percent fall in 2008 earnings and, as expected, a surge in bad debts in the US. Pretax profits of HSBC's core business in Asia fell 11 percent last year. The bank's Hong Kong business also saw a significant fall in the same period. HSBC's profit before tax in Asia declined to $11.9 billion in 2008, while its earnings in Hong Kong slumped 26 percent to $5.46 billion, weighed down by the weak equity market performance in the territory.

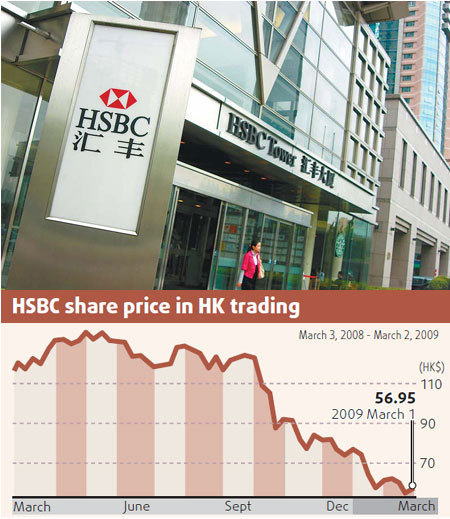

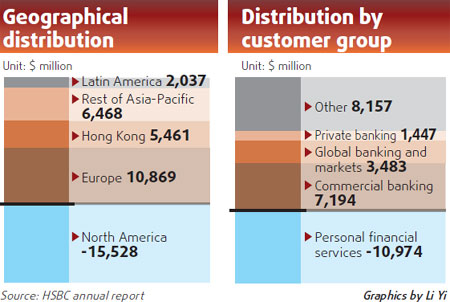

Chief Executive Officer Michael Geoghegan said the decline in earnings of the bank's business in Hong Kong was "mainly reflected in the lower wealth management and insurance income in the deteriorating economic climate." Net interest income in Hong Kong rose by 4 percent, boosted by the liquidity generated from the retail banking environment of falling short-term interest rates. The territory's loan impairment charges and other credit risk provisions increased from the previously low level to $765 million, due to the deteriorating economic conditions. Fee income, meanwhile, dropped 23 percent, following a fall in equity market-related revenue. Weak market sentiment led to lower retail brokerage volumes and lower income from wealth management, the bank said. However, the bank's core business in the rest of Asia-Pacific jumped 27 percent to $6.5 billion in its pre-tax profits. HSBC's individual markets in Asia have performed strongly, with profits in India increasing 26 percent to $666 million. Its operations on the Chinese mainland surged 64 percent to $319 million while the Middle East operations rose 34 percent to $1.7 billion. Speaking at the bank's press conference yesterday, Group Chairman Stephen Green said business growth of HSBC in Asia, excluding Japan, remains robust. Vincent Cheng, Chairman of HSBC Asia-Pacific, said the bank's commercial and retail business was performing extremely well in Asia. Europe's largest bank is in the process of offering 5.1 billion new shares at 254 pence apiece, or a 48 percent discount on Friday's closing price, for subscription by its existing shareholders. In Hong Kong, the issue price per new share is at HK$28, or a 50.2 percent discount to its Friday close of HK$56.95. Group Chairman Stephen Green disagreed that the rights issue had come too late. "I think it is the right timing when we get the information about our 2008 performance." HSBC's finance director Douglas Flint said: "We want to position ourselves both defensively for turbulent times and opportunistically for the options that will appear." Patrick Shum, Karl Thomson Securities' chief portfolio strategist, said HSBC had missed the golden time for issuing new shares - when the Hang Seng Index was above the 15000-mark. "The managements might think that they could handle the problems themselves," he said. He said individual shareholders have no option but to accept the offer. "If they do not buy the new shares, their shareholding will be diluted. That will make them lose money, since many of them have been holding the shares for long," he said. The rights issue is subject to shareholder approval on March 19. This will add 150 basis points to HSBC's capital ratios, strengthening the core tier 1 ratio to 8.5 percent. The bank also said pre-tax profit last year fell 62 percent to $9.3 billion from $24.2 billion a year earlier after it was hit by a goodwill impairment charge of $10.6 billion in the US. Excluding the charge, pretax profit fell by 18 percent to $19.9 billion, slightly ahead of the $19 billion expected by analysts. The bank cut its dividend for the full year by 29 percent to 64 cents per share and said it would close its troubled US consumer loans business. The bank maintained a dividend growth of 10 percent or more per annum up to 2007. HSBC's losses in North America last year amounted to $15.5 billion, including the $10.6 billion goodwill impairment charge, stemming from its troubled acquisition of Household, the US consumer lending business it bought six years ago for $14 billion. "With the benefit of hindsight, this is an acquisition we wish we had not undertaken," Green said, for the first time admitting that the bank had made a wrong decision in acquiring Household. Green said that the credit environment has experienced fundamental changes over the past year. "It's a painful decision to close the business," he said: "We don't want to make people redundant as well." The bank said it would close the majority of its HFC and Beneficial-branded US branch network, resulting in the loss of 6,100 jobs and that, with the exception of credit cards, the US divisions would write no further consumer finance business. Group-wide, the bank said that losses on bad loans jumped 44 percent versus 2007 to $24.9 billion.

(For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 安陆市| 繁峙县| 郑州市| 平和县| 商洛市| 全椒县| 台前县| 卢湾区| 乌什县| 万盛区| 通榆县| 西盟| 浠水县| 巴南区| 静乐县| 玉龙| 丹棱县| 芒康县| 略阳县| 黔西县| 渑池县| 康乐县| 凤凰县| 海门市| 南充市| 金门县| 长顺县| 贵港市| 叶城县| 延安市| 界首市| 文化| 三明市| 监利县| 江门市| 扬中市| 廊坊市| 阜城县| 三江| 剑河县| 云龙县| 财经| 天峨县| 达孜县| 上饶市| 余江县| 松溪县| 卓资县| 遂川县| 大连市| 唐海县| 六枝特区| 乃东县| 长泰县| 黔江区| 花垣县| 阳山县| 徐州市| 射阳县| 个旧市| 鹤庆县| 长白| 鄯善县| 天长市| 宁夏| 周口市| 资中县| 华容县| 彭山县| 济南市| 共和县| 尼木县| 阿鲁科尔沁旗| 宣化县| 天镇县| 南丹县| 迁安市| 延吉市| 潼南县| 古蔺县| 望城县| 兰溪市|