|

BIZCHINA> Top Biz News

|

|

New VC funds mostly in yuan

By Zhang Ran (China Daily)

Updated: 2009-03-09 07:49

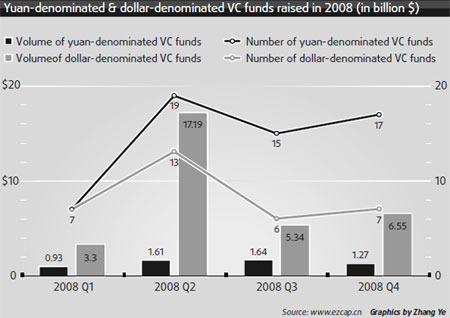

China's venture capital (VC) market had 91 new funds in 2008, a 57 percent increase from 2007, according to a recent report released by EZCapital & HolyZone, a consulting firm.

There were 58 yuan-denominated funds (63 percent) and 33 dollar-denominated funds (37 percent), mostly due to the government's efforts to promote such funds. Yuan-denominated funds accounted for 43 percent of new venture capital funds in 2007. China released new statutes and codes to regulate the mainland venture capital market, giving local funds a healthy development environment and made progress on setting up a trading board for start-up companies, the Growth Enterprises Board (GEB), which will further boost yuan-denominated funds. But most of the yuan-denominated funds were small. Their average value was around 672 million yuan ($96 million), one-ninth the average of the dollar-denominated funds.

The top three yuan-denominated funds were Hony Capital (the investment arm of Legend Holdings), the Overseas Chinese Investment Fund and Tianjin Binhai New Area Venture Capital Guiding Fund. Hony Capital was raised in September and has a value of 5 billion yuan. Tianjin Binhai New Area Venture Capital Guiding Fund, which is operated by the Tianjin municipal government, was raised in March and is worth 4.7 billion yuan. The Overseas Chinese Investment Fund, raised in April, has a value of 5 billion yuan. The financial crisis may have helped the number of new dollar-denominated venture capital funds last year as nervous investors sough safer investment in China. Australia-based CVC Capital Partners Asia-Pacific III L.P (Fund III) raised $4.1 billion to invest in well-running businesses in the Asia-Pacific region last April. Fund III is the region's largest. In August La Salle Investment Management raised $3 billion. CDC Capital Partners raised $2.9 billion in December. (For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 江源县| 修文县| 贞丰县| 廉江市| 天水市| 瓦房店市| 房山区| 普格县| 乌拉特前旗| 蓝山县| 天水市| 兴业县| 镇坪县| 伊春市| 菏泽市| 泊头市| 饶河县| 安远县| 马鞍山市| 江西省| 宜丰县| 塔河县| 鄂托克前旗| 甘肃省| 阳新县| 大名县| 冷水江市| 浙江省| 黑水县| 酉阳| 托克托县| 云霄县| 栖霞市| 衡阳县| 兖州市| 开封县| 罗定市| 鄄城县| 寻乌县| 丰宁| 合山市| 辰溪县| 泸定县| 武夷山市| 乌鲁木齐县| 平遥县| 金乡县| 教育| 军事| 抚顺市| 塘沽区| 莎车县| 敖汉旗| 蓬安县| 丰城市| 黔西| 白玉县| 铜鼓县| 轮台县| 铅山县| 阿坝| 武义县| 南江县| 南汇区| 青州市| 耿马| 花莲县| 彰化市| 鄂伦春自治旗| 汨罗市| 梅州市| 绥中县| 花莲县| 景东| 钦州市| 绥化市| 荣昌县| 庆云县| 乌什县| 吉安市| 年辖:市辖区| 丰宁|