|

BIZCHINA> Top Biz News

|

|

Consumer prices fall in February

By Zhang Ran (China Daily)

Updated: 2009-03-11 08:00

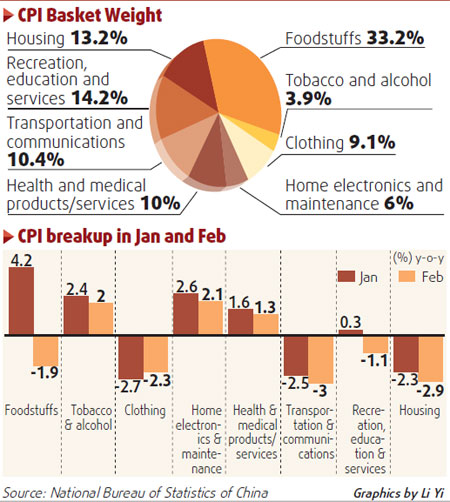

China's consumer price index (CPI) dropped 1.6 percent year-on-year in February, the first negative growth since December 2002, according to figures released by the National Bureau of Statistics (NBS) yesterday.

China's tightening monetary policy starting at the end of 2007 caused the CPI to start falling in May after it peaked at 8.7 percent in February last year. It fell to 1 percent in January, the lowest in 30 months. "However, it is too early to draw a conclusion of deflation in China," the NBS said in a statement on its website. "The CPI fall has been mainly due to lower raw material prices. It was also affected by the timing of the Lunar New Year holiday, which fell in February last year but was in January this year. The unprecedented snowstorm in February last year also pushed up food prices." Since the base effect has been the toughest, many believe that in the coming months, CPI readings would have easier comparisons and could appear less negative on the surface. "We expect the deflation in CPI to be temporary, as it has mainly been caused by a very high base in February last year," said Sun Mingchun, former economist of Lehman Brothers Asia, who now works with Nomura International (HK) Ltd. "As the base effect fades and the impact of the government' stimulus package gradually drives up producer prices, we expect inflation to return in the second half and touch 2.8 percent year on year in the fourth quarter. For the full year, we expect CPI inflation to average 0.6 percent, a sharp drop from 5.9 percent in 2008," he said. Li Daokui, economist, Tsinghua University, agrees, saying that the figures may rebound in the second quarter. However, Ken Peng, an economist with Citigroup said, the negative CPI could persist for most of this year, especially as more producer price declines could impact consumer prices in an environment of overcapacity. "Even though the recent credit boom has reduced the urgency, we believe that further monetary easing is still necessary. Interest rate cuts are likely, and the bank reserve requirement ratio (RRR) may have greater room for reduction," he said. "CPI will remain in the negative zone in the coming months," JPMorgan Chase Bank's Asian economic researcher Wang Qian said. (For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 郎溪县| 泽普县| 鄂温| 即墨市| 武陟县| 济源市| 海宁市| 天气| 印江| 大城县| 和田市| 大足县| 桃江县| 禄丰县| 黑水县| 长子县| 临沂市| 维西| 图片| 安徽省| 商南县| 建瓯市| 盈江县| 江华| 新津县| 黎川县| 新宁县| 铜陵市| 张北县| 乌海市| 罗平县| 凯里市| 南丹县| 康平县| 叶城县| 垣曲县| 双牌县| 淮阳县| 祁东县| 兴文县| 东安县| 阿拉善盟| 伊春市| 闸北区| 房产| 姜堰市| 南和县| 红安县| 青海省| 昆山市| 汝州市| 平泉县| 井陉县| 普兰店市| 兖州市| 象州县| 阿拉尔市| 太谷县| 青龙| 分宜县| 清徐县| 普定县| 凯里市| 乌拉特后旗| 麻江县| 东光县| 新昌县| 寿宁县| 临湘市| 托克托县| 娄烦县| 贡山| 马关县| 阆中市| 丁青县| 红安县| 连云港市| 罗山县| 加查县| 调兵山市| 福安市| 重庆市|