|

BIZCHINA> Top Biz News

|

|

Investment in Chinese firms sags

By Bi Xiaoning (China Daily)

Updated: 2009-03-23 07:43

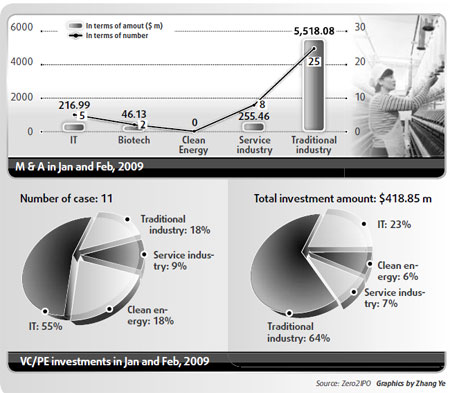

Private equity and venture capital firms have substantially slowed their investment in China according a recent report from Chinese market research company Zero2IPO Group. Private equity and venture capital firms have invested about $419 million in 11 companies in China over January and February, said the report. They invested $3.62 billion in 152 companies in China in the first quarter last year.

Domestic venture capital firms have been involved in an increasing number of deals over the last few years. They made 270 deals in 2008, not far behind the 296 made by foreign venture capital companies. The report also revealed that venture capital and private equity firms favored companies in the traditional sector and IT industry, with 64 percent and 23 percent of investment, respectively, flowing to those industries. Venture capital and private equity firms are taking a break from raising capital in the current economic downturn, the report said. Only 10 investment institutions set up new funds in January and February. "It's not easy to raise capital these days but China could still be an attractive market for venture capital firms. Favorable policies for the venture capital industry are likely to come out in the next two years," said Ni. Venture capital firms have played an active role in China's capital market. The market value of venture capital-backed Chinese listed companies has exceeded $80 billion over the last 10 years, according to Zero2IPO. There are 89 venture capital-backed companies listed on the overseas market with a combined market value of $52.3 billion. There are 84 on the domestic market with a total market value of $29.9 billion. The report also noted that merger and acquisition activity flourished in the first two months of the year. There were 51 such transactions worth about $6 billion in January and February, the report said. "The government has been focused on upgrading the country's industrial structure which obviously boosts acquisitions," said Zheng Xingguo, vice-president with Zero2IPO Group. (For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 墨脱县| 渝北区| 定边县| 普格县| 渭南市| 营山县| 峨眉山市| 彭阳县| 双江| 西峡县| 永嘉县| 呼和浩特市| 商城县| 红安县| 大荔县| 屏山县| 马边| 富阳市| 石首市| 饶阳县| 商河县| 策勒县| 正安县| 邵东县| 峨山| 稻城县| 都昌县| 甘德县| 江阴市| 余江县| 广东省| 巫溪县| 太仆寺旗| 云浮市| 洛隆县| 商南县| 定结县| 城口县| 凌海市| 孙吴县| 贵南县| 新化县| 宁都县| 青龙| 新蔡县| 高清| 宜章县| 巴林右旗| 潼南县| 兰州市| 朝阳市| 浦县| 常宁市| 瑞丽市| 兴仁县| 江油市| 新乡县| 尚义县| 民和| 布拖县| 郧西县| 樟树市| 云林县| 开原市| 海口市| 石泉县| 稷山县| 湘潭市| 聂荣县| 长白| 拉萨市| 资阳市| 博乐市| 谢通门县| 灯塔市| 枣庄市| 张家口市| 新营市| 登封市| 武强县| 肇庆市| 宁晋县|