|

BIZCHINA> Top Biz News

|

|

China cash to prop up Oz coal venture

(China Daily/Agencies)

Updated: 2009-05-28 08:08

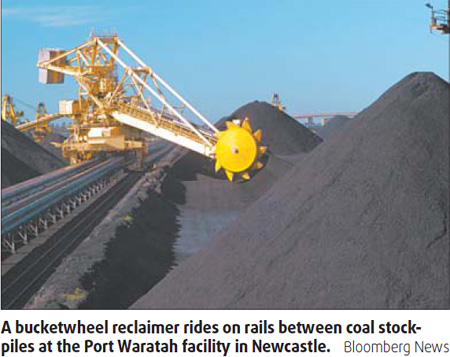

Waratah Coal Inc, the Australian company proposing a $5.15 billion venture in Queensland, said it signed an agreement that will see China Metallurgical Group Corp organize funding for as much as 70 percent of the project. An estimated $3.1 billion will be borrowed from Chinese banks, the Brisbane-based company said yesterday in a statement. China Metallurgical, a State-owned construction and resources exploration company, will also take a 10 percent stake in the project, called China First, for about $515 million. The project, described by Waratah Coal as the nation's largest thermal coal mine, will generate as much as A$4 billion of sales a year and A$70 billion during its lifespan, and regulators would be "mad" to block the equity sale, according to Chairman Clive Palmer. Australia in February established a Senate inquiry into foreign ownership. "The project has been named China First, which probably reads well in Beijing," Andrew Harrington, a mining analyst at Patersons Securities Ltd, said by phone from Sydney. "At this moment, the great savior is Chinese demand. That is the destination for a lot of our natural resources." Waratah was acquired by Mineralogy earlier this year and its securities de-listed from the Toronto and Australian stock exchanges in April. "There are no nuts and bolts about the project in the statement," Harrington said. "The company is privately listed, so there probably won't be any." China Metallurgical will be the project's engineering, procurement and civil contractor. It will buy 30 million metric tons of coal a year, which is 75 percent of its projected annual capacity, according to yesterday's statement to the Australian stock exchange. "This project is creating 6,000 direct jobs from construction, 1,500 from operations, 45,000 indirect jobs and about A$3 billion to A$4 billion in exports," Palmer said in a phone interview from Brisbane. "We're locking in long-term contracts over 30 years. Any government that didn't approve that would be mad, especially when you're talking about 10 percent, which is nothing really. We may as well kiss Australia goodbye if we have any problem with that."

On May 22, the company said it had expanded proposed capacity at the Galilee Basin mine by 60 percent, giving it increased targeted annual capacity to 40 million tons. The venture will comprise the mine, a 490-km rail line and export terminal, with shipments due to start in the second half of 2013, making it Australia's largest coal project, Waratah said. Overseas deals booked by Chinese utilities have led to expectations for a possible tripling in thermal coal imports to about 30 million tons in 2009, Barclays Capital said in a report published May 19.

(For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 昌邑市| 萨嘎县| 武功县| 同仁县| 体育| 沁水县| 定西市| 安丘市| 阜宁县| 荥经县| 玉环县| 来凤县| 涿鹿县| 麻城市| 澄迈县| 吴堡县| 固始县| 邛崃市| 南宁市| 息烽县| 南宁市| 丽江市| 谷城县| 张家川| 安陆市| 凉城县| 昆明市| 伊宁市| 长沙县| 礼泉县| 广宗县| 扶沟县| 湘乡市| 德保县| 酒泉市| 泸水县| 织金县| 宁南县| 潼关县| 纳雍县| 漯河市| 溆浦县| 突泉县| 那曲县| 蓬溪县| 南京市| 凤山市| 岳阳县| 嵩明县| 葵青区| 兴和县| 修武县| 湖南省| 庄河市| 鹤岗市| 耒阳市| 嘉兴市| 台安县| 临汾市| 兰州市| 会宁县| 大化| 老河口市| 体育| 新安县| 甘谷县| 淄博市| 迁西县| 确山县| 彭山县| 鄱阳县| 理塘县| 康马县| 太仆寺旗| 兰溪市| 天长市| 朝阳县| 阳春市| 扎兰屯市| 连平县| 长治县| 金沙县|