|

BIZCHINA> Top Biz News

|

|

Mainland stocks headed for 'sizable correction'

(China Daily/Agencies)

Updated: 2009-07-09 08:00

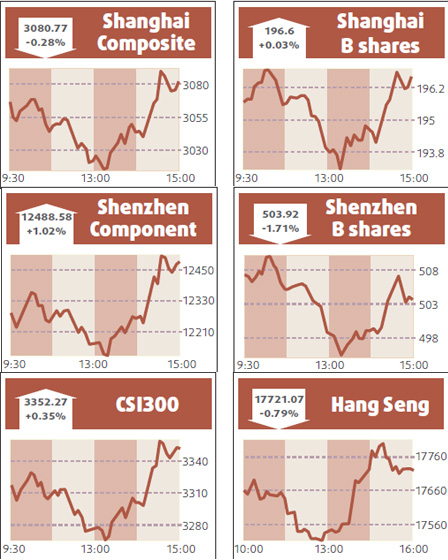

Mainland stocks may be headed for a "sizable correction" after a so-called momentum indicator for the Shanghai Composite Index advanced to the highest in at least five months. The 14-day relative strength index, or RSI, for the Shanghai Composite climbed to 83 this week, above the 70 threshold that signals to technical analysts an asset or market is poised to fall. The indicator compares the magnitude of recent gains to losses. The last time the Shanghai gauge's RSI breached the 80 level, in February, the stock measure sank as much as 13 percent in following two weeks. "The RSI shows that the market is in a pretty overbought situation," said Barole Shiu, a Hong Kong-based technical analyst at UOB-Kay Hian Ltd. "If history repeats itself, there is a very strong chance we'll see a sizable correction."

At the stock measure's peak in October 2007, its RSI reached 79.6, a level not seen again until this year. The Shanghai Composite plunged 72 percent in the following 12 months before rebounding, according to data tracked by Bloomberg. Shiu said the Shanghai A Share Index, the stock gauge he tracks, may fall at least 200 points, or 6 percent, before finding a support at around 3000. The measure, which tracks only yuan-denominated shares traded in Shanghai, yesterday closed at 3243.29. Its RSI climbed to 83.1 on July 6. "The Shanghai Composite moves in more or less a similar pattern to the Shanghai A Share Index," he said. Hang Seng declines Hong Kong stocks dropped, dragging the Hang Seng Index to a two-week low, as lower oil and metal prices dragged commodity stocks lower. Property and banking shares declined on concern the government will restrict lending for real estate investment. "We've seen a massive rally with very little correction. People got carried away and are just beginning to be a little bit realistic," said Khiem Do, head of multi-asset strategy at Baring Asset Management (Asia) Ltd. The Hang Seng Index lost 0.8 percent to 17721.07 at the close. The Hang Seng China Enterprises Index dropped 1 percent to 10573.71.

(For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 陵水| 额敏县| 石阡县| 南雄市| 莱芜市| 武夷山市| 南昌市| 枣阳市| 新平| 宜都市| 舟山市| 静乐县| 东莞市| 玛纳斯县| 方城县| 育儿| 呼图壁县| 竹山县| 克东县| 贞丰县| 诸城市| 宣城市| 盖州市| 临猗县| 镇远县| 象州县| 闽清县| 伊宁县| 深州市| 新密市| 武隆县| 增城市| 利川市| 固始县| 巨鹿县| 永安市| 石楼县| 昌黎县| 乌拉特后旗| 凤凰县| 额尔古纳市| 周至县| 金山区| 沅江市| 城市| 榆树市| 泗水县| 固始县| 东宁县| 亳州市| 桦南县| 勃利县| 临猗县| 乌兰县| 同德县| 清水县| 亳州市| 涿州市| 定日县| 逊克县| 隆德县| 乌什县| 浮山县| 郧西县| 柳州市| 丽江市| 大荔县| 洛宁县| 新沂市| 伊川县| 定西市| 巫溪县| 韶关市| 大石桥市| 托克逊县| 滨海县| 秦皇岛市| 波密县| 宝丰县| 济南市| 韩城市| 舟曲县|