|

BIZCHINA> Top Biz News

|

|

Cut in holdings of US debt may help diversify China's reserves

By Si Tingting (China Daily)

Updated: 2009-08-19 07:22

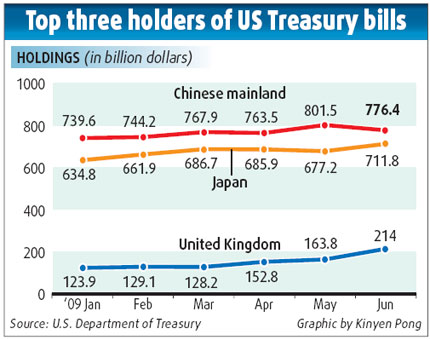

China drastically cut its holdings of US Treasury debt in June, but its purchase of more long-term securities indicates no significant change in its interest in US government bonds. The country's holding of US Treasury securities fell to $776.4 billion in June, from a record high of $801.5 billion in May. Despite the biggest monthly drop since 2000, China still retained its position as the top holder of US treasuries, according to US Treasury data released on Monday. While slashing its holdings of short-term bills by 25 percent, to $158.7 billion, China rotated into longer-dated maturities by $27 billion, a 4.5 percent increase.

"The fact that China has now returned and bought long-term notes is an encouraging sign," Patrick Bennett, Asia Foreign Exchange Rates Strategist with Societe Generale in Hong Kong, told China Daily. "It shows that China, as an investor, sees value in the issues and this speaks to the credibility of US policies." Bennett dismissed the idea that China's reduction in the holding of US treasuries represents "a big move". "The change is a slight surprise, but we need to see the next couple of months' data before determining the trend of purchases," he said.

"The recent pattern suggests China hastened its effort to diversify its international reserves," Crescenzi said. China's foreign exchange reserves totaled $2.13 trillion at the end of June. Yin Zhongli, a senior researcher with the financial research institution of the Chinese Academy of Social Sciences, believes that the share of US dollar-dominated assets in China's foreign exchange reserves is too large. "So, we have to diversify our portfolio for risk aversion," Yin said, adding that the country might buy more assets denominated in other foreign currencies, such as the euro, the Japanese yen and the Australian dollar. "But investment in US treasuries is still relatively safe compared with other options, because the recovery of the US economy is, by and large, stronger than other major economies, such as the European Union," he said. (For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 博爱县| 安化县| 齐齐哈尔市| 唐海县| 景东| 进贤县| 南充市| 沧源| 康乐县| 股票| 万山特区| 万州区| 铜川市| 枣庄市| 垣曲县| 荣昌县| 嘉义市| 古交市| 璧山县| 聂拉木县| 衡水市| 额济纳旗| 东阳市| 民权县| 奉节县| 崇州市| 景德镇市| 宁国市| 建平县| 巴林左旗| 荔波县| 浦城县| 堆龙德庆县| 广水市| 大洼县| 壤塘县| 洛扎县| 昆明市| 双桥区| 边坝县| 敦煌市| 旅游| 景泰县| 吉木萨尔县| 库伦旗| 麻江县| 山阴县| 兴隆县| 利辛县| 青川县| 洪泽县| 林口县| 淮滨县| 名山县| 黄浦区| 土默特左旗| 金川县| 游戏| 潞城市| 和政县| 隆昌县| 黄浦区| 朔州市| 惠州市| 集安市| 河北省| 威海市| 体育| 鸡西市| 休宁县| 云浮市| 房产| 徐水县| 新营市| 皮山县| 商水县| 东宁县| 连南| 罗山县| 孝昌县| 伊金霍洛旗| 张家口市|