Top Biz News

Avoid risky Greek debt buy, says Yu

By Xin Zhiming (China Daily)

Updated: 2010-01-29 08:07

|

Large Medium Small |

China could consider using the framework of the European Union (EU) or the International Monetary Fund (IMF) to help Greece out of its debt crisis, said Yu Yongding, an influential economist and former adviser to the central bank.

"Let European governments and the European Central Bank rescue Greece and China can try its best to help Greece via the EU or the IMF, which has an institutional framework in place for such problems," he said.

The nation should, however, tread cautiously on buying Greek government bonds - if media reports that the country is trying to sell debt to China are true - given the potential risks, Yu, an economist from the Chinese Academy of Social Sciences, said yesterday.

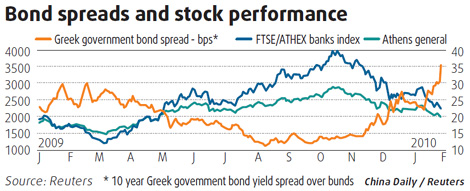

Greece is seeking to raise 53 billion euros ($74 billion) in funds this year to reduce a budget deficit of almost 13 percent of its gross domestic product (GDP), the biggest shortfall in the European Union. It reportedly is persuading China to buy as much as 25 billion euros of its bonds.

"Twenty-five billion euros is not a small sum (for China)," Yu told China Daily, adding that he as an economist had no knowledge of whether China and Greece are discussing the matter.

Technically, it is not a good deal for China to buy Greek bonds, he said.

Greece has a lower debt rating than the US and its statistics have been challenged by the European Commission, said Yu. "It is unreasonable for an economist to support a diversification from an unsafe asset class to a much more unsafe asset class."

The Greek Finance Ministry has denied reports in the Financial Times that it was wooing China to buy its bonds. A State Administration of Foreign Exchange official said he had not heard about the plan for China to buy Greek debt, according to Bloomberg.

But such reports have aroused a stir in China as the country is trying to make use of its massive $2.4 trillion foreign exchange reserves more efficiently, ensuring both safety and investment returns. China cut its holdings of US Treasuries by $9.3 billion in November to $789.6 billion, but still remains the largest holder of American paper, according to US Treasury Department data.

The country's huge holdings have triggered concerns that China may incur huge losses in the future when the dollar value drops.

| ||||

"This year could be a turning point for the Chinese economy," he said.

Many analysts said that with China starting to exit slowly from the stimulus plan, the economic growth would ease. Therefore, China must be careful while using its reserves, Chen said.