Top Biz News

BRICs rally slows amid high valuations

By Michael Patterson (China Daily)

Updated: 2010-03-19 09:30

|

Large Medium Small |

|

|

|

An investor monitors share movements at a brokerage in Wuhan, Hubei province. Emerging-market stock funds lured $ 86.6 billion in the year through January. |

LONDON - The combination of record mutual fund inflows and the fastest economic growth are failing to lift shares in the largest developing nations with valuations at the highest level versus developed countries since at least 1995.

Emerging-market stock funds lured $86.6 billion in the year through January, the most in 14 years of data, according to Cambridge, Massachusetts-based researcher EPFR Global.

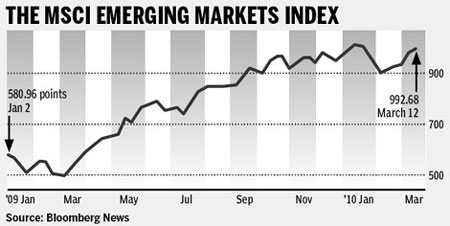

MSCI's developing nation index slid 2.2 percent from this year's peak on Jan 11 and pared an 80 percent rally in the previous 12 months that sent its price-to-book ratio to a record 17 percent over the MSCI World Index, data compiled by Bloomberg show.

For BlackRock Inc's Bob Doll, the declines won't last as developing country equities deserve higher valuations for their faster economic growth, bigger profits and lower debt than developed nations.

Gartmore Group Ltd's John Bennett says the best gains may be over, while Antoine van Agtmael, who coined the term "emerging markets", predicts shares will take a "breather" this year before resuming a long-term advance.

"It's not a good idea to buy super-duper growth when it's already priced for super-duper growth," said Bennett, the London-based lead manager of the $2.6 billion Gartmore European Selected Opportunities Fund, which beat 97 percent of its peers in the past five years with a gain of 65 percent.

While the MSCI emerging gauge is 25 percent lower than its October 2007 peak, the rally pushed its price relative to net assets, a measure of long-term value cited by Templeton Asset Management Ltd Chairman Mark Mobius, to 2.17 on Jan 6.

Record premium

That's a record 17 percent more than the MSCI World index's price-to-book ratio of 1.84, Bloomberg data show. The premium, which has lasted 10 months, was 15 percent on Wednesday, compared with an average discount of 36 percent since Bloomberg began compiling the data in January 1995.

The MSCI emerging index's 1.9 percent gain this year trails a 3 percent rise in the MSCI World and 4.5 percent climb in the Standard & Poor's 500 Index.

Brazil's Bovespa has risen 2.6 percent, while the Micex in Russia is up 4.8 percent. India's Bombay Stock Exchange Sensitive Index has advanced 0.1 percent and China's Shanghai Composite Index is down 6.9 percent.

"We need a bit of a breather," said Van Agtmael, who first used the term "emerging markets" in 1981 and now helps manage about $13 billion as chairman and chief investment officer of Emerging Markets Management LLC.

"It's not going to be the panic of 2008 and it's not going to be this fabulous year we had last year."

The MSCI Emerging Markets Index was little changed at 1,005.78 as of 4:45 am in London.

Concern that China, the world's biggest developing economy, will pare economic stimulus measures to slow gains in consumer prices and real estate is weighing on emerging markets, said Mikio Kumada, a senior market analyst at LGT Capital Management in Singapore.

The People's Bank of China raised reserve requirements for the biggest lenders twice this year in a bid to curb credit growth.

Inflation is also rising in India and Brazil, increasing pressure on those nations' central banks to raise borrowing costs. India's inflation accelerated to a 16-month high in February, while consumer prices in Brazil rose at the fastest pace in 21 months.

The International Monetary Fund forecasts emerging markets as a group will expand 6 percent this year, leading the global recovery, compared with 2.1 percent for developed economies.

Lower leverage

Emerging-market stocks still may outperform developed-nation shares because of higher profits and lower debt, said Doll, vice-chairman and global chief investment officer for equities at New York-based BlackRock, which oversees more than $3 trillion.

|

||||

Profits at companies in the MSCI emerging index may jump 29 percent in 2010, compared with 20 percent for the MSCI World, based on at least 2,400 analyst projections compiled by Bloomberg.

"Growth is faster, profit margins are higher and leverage is lower," said Doll. "That does warrant a premium."

The MSCI emerging gauge's price-to-book ratio is down from a record 2.96 in October 2007, according to Bloomberg data. The 22-country gauge trades for 13.1 times analysts' estimates for 2010 earnings, lower than the ratio of 15.1 for the MSCI World, Bloomberg data show.

Bloomberg News

| 分享按鈕 |