Money

New lending slows on government curbs

By Wang Bo (China Daily)

Updated: 2010-04-13 09:27

|

Large Medium Small |

An employee counting banknotes at a Minsheng Bank branch in Nanjing. China's M2, the broad money supply, increased 22.5 percent year-on-year in March. [China Daily]

Bank disbursals come down as steps help reduce inflation risks

BEIJING - Bank lending slowed in March as the government took further steps to rein in credit, amid rising inflation and asset bubble risks.

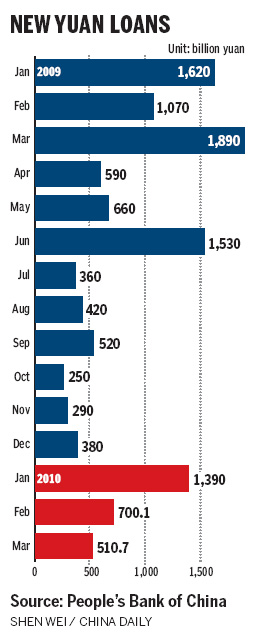

Chinese banks advanced 510.7 billion yuan ($75 billion) in new loans in March, down from the 700.1 billion yuan in February, the People's Bank of China, the nation's central bank, said on Monday.

That puts the total new loans for the first quarter at 2.6 trillion yuan, higher than the government targeted 2.25 trillion yuan, or some 30 percent of the planned 7.5 trillion yuan for the whole year.

"It is quite normal for the level of new loans in the first three months to exceed the planned target, as Chinese banks tend to lend more at the beginning of the year," E Yongjian, senior analyst at the research department of Bank of Communications, said.

"Besides follow-up funds for the existing government-backed projects, we will see more credit going for private sector support, including mortgage loans," he said.

The fresh credit for the first three months is about half of the record 4.58 trillion yuan disbursed by Chinese banks a year ago, when the economy took a hard hit from the global financial crisis.

The average monthly new loans in the first quarter stood at around 860 billion yuan, compared with 444.2 billion yuan and 1.5 trillion yuan during the same periods of 2008 and 2009.

"The pace of credit growth will gradually return to normal as the record money supply from a year back would help shore up the Chinese economy effectively," a source at the nation's banking regulator said.

The country's M2, or the broad measure for money supply that includes cash and all types of deposits, grew 22.5 percent year-on-year in March, down from 25.5 percent year-on-year growth in February, the central bank said in the statement.

The Chinese government has set the money growth rate at 17 percent this year, while the four biggest State-owned lenders, which usually account for some 40 percent of the total new loans annually, have targeted credit expansion at roughly 17 percent in 2010.

Even as the government took measures to curb credit expansion, it is also aiming to exit from the stimulus policy and ease worries of economic overheating. At the same time, it does not want to disturb the fundamentals for strong economic growth due to improper policy tightening.

Analysts said with the lending pace slowing in the past few months, there is enough room for the government to consider an interest rate hike, a clear signal of serious policy tightening.

"Policymakers in Beijing have taken their foot off the accelerator, but have not yet hit the brakes," Stephen Green, Standard Chartered Bank's head of China research, said in a research note.

Chen Xi, a Shenzhen-based banking analyst with First Capital Securities, said the expectation of a mild yuan appreciation in the near term could help ease the inflationary pressure triggered by the soaring commodity prices in international markets.

"That will postpone the government's planned interest rate hike, as the policymakers need several months after the yuan appreciates to decide if a tighter monetary policy is still necessary," she said.