Money

Equities tumble on realty curbs

By Wang Ying (China Daily)

Updated: 2010-04-20 09:09

|

Large Medium Small |

|

|

|

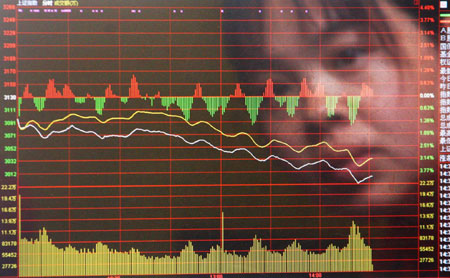

An investor looks at share price movement at a brokerage in Beijing. [NAN SHAN / FOR CHINA DAILY] |

Benchmark slides 4.8% in Shanghai, biggest daily fall in eight months

Equities declined sharply on Monday at the Shanghai and Hong Kong bourses, after the government took more steps to rein in the sizzling real estate market.

The benchmark Shanghai Composite Index fell 4.79 percent to 2,980.30, while the Shenzhen Component Index dipped 6.22 percent to 11,644.58. Turnover on the Shanghai bourse rose to 156.39 billion yuan, up 51.98 percent from Friday.

Hong Kong's benchmark Hang Seng Index shed 2.1 percent to 21,405 points, a three-week low and the biggest one-day drop in two months.

The property sector in the mainland market declined nearly 7.7 percent after the central government ordered lenders to raise down payment requirements and asked local governments to curb speculative buying in real estate. Of the 99 sectoral stocks, 25 declined to the daily 10 percent limit.

Prominent among the big losers on Monday were COFCO Property (Group) Co Ltd, Shimao Property Holdings Ltd, and Shanghai New Huangpu Estate Co Ltd.

China Vanke Co Ltd, the nation's leading property developer, fell nearly 8.19 percent to 8.30 yuan, its biggest fall in a year. Poly Real Estate (Group) Co fell 9.28 percent to 16.92 yuan.

"The steps to tighten bank mortgage loans will impact the realty market prospects in major cities," said Guo Feng, an analyst at Northeast Securities.

The government raised the required down payment for second-home purchases from the existing 40 percent to 50 percent on Thursday. First time buyers of apartments larger than 90 square meters are required to put up a minimum 30 percent down payment for their mortgages.

Furthermore, banks have also been asked to stop loans for third-home purchases in cities with excessive property price gains and suspend lending to non-residents without proof of tax returns or social security contributions in the past year, according to a statement from the State Council on April 17.

Local governments may also limit the number of units that can be bought, the statement said.

"This is by far the strongest market reaction after the government decided to step in and check the runaway rise in property prices by tightening mortgage rules," said Shi Weixiang, an analyst at Guotai Junan Securities.

Influenced by property stocks, lenders also sought lower levels on concerns that non-performing loans would increase, said Guo.

Bank of Ningbo declined 9.32 percent to 14.21 yuan. Industrial Bank lost 8.02 percent to 31.08 yuan.

Securities firms were also among the losers. Everbright Securities retreated 9.12 percent to 23.92 yuan, while Haitong Securities shed 7.78 percent to 14.93 yuan.

Both lenders and securities firms also felt the "Goldman effect" after the US Securities and Exchange Commission said it was filing fraud charges against Goldman Sachs.

Resource stocks had their share of problems too. The fall in commodity prices globally saw sectors like coal, oil and non-ferrous metals retreating.

|

||||

The straw that broke the camel's back was the newly launched index futures, regarded as a speculative tool for investors to earn money from a lower stock index, said Yang Jianbo, an analyst at Sinolink Securities.

"Although the index futures would in the long term help stabilize the stock market, at least for now, it is more of speculation than any positive effect," Yang said.

Yang said that the capital market has overacted on the recent policies, while others like Shi from Guotai Junan Securities feel that bourses are in a medium-term adjustment stage lasting for three to six months.