Money

CMB looks further abroad

By Wu Chong and Huo Yongzhe (China Daily)

Updated: 2010-05-03 09:11

|

Large Medium Small |

|

|

|

A woman walks past a China Merchants Bank Co branch in Beijing.[Agencies] |

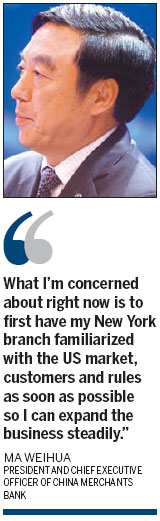

NEW YORK - Ma Weihua, president and chief executive officer of China Merchants Bank (CMB), said he wanted to see Chinese banks elevate their level of globalization in the context of expedited overseas expansion of Chinese companies during his bank's recent road show in the United States. He said CMB would pursue this process ambitiously but cautiously.

The bank is soon to relocate its night-shift foreign exchange trading team to its New York branch, which was established in 2008, and will move on to security trading as well in the future, according to Ma during a group interview. The branch is also working on consolidating its dollar settlement business.

"What I'm concerned about right now is to first have my New York branch familiarized with the US market, customers and rules as soon as possible so I can expand the business steadily," Ma told the audience at a recent speech at New York University's Leonard N. Stern School of Business. "We won't consider faster expansion until we have secured our position here."

Because of policy restrictions, CMB and other Chinese banks are only able to provide very limited services overseas for now. Retail banking, which CMB is best at, is still being constrained in its New York branch, its first branch in the West. But the bank is eyeing up other opportunities.

The branch is attaching increasing importance to the loan business for Chinese companies during their overseas merger and acquisition activities. It just completed a big deal for a Chinese State-owned conglomerate but declined to reveal its name. .

"The most fundamental motive to globalize our bank is to support Chinese companies' overseas growth and to provide the same quality service for foreign companies as well when they come to China," Ma said.

According to Ma, over the past five years, Chinese companies' overseas direct investment saw an annual increase of 60 percent and their non-financial overseas investment grew by 68.5 percent year-on-year.

In comparison, overseas assets only make up less than 4 percent of Chinese banks' total assets, while in large banks in Europe and the US, the proportion is about 40 percent, he said.

"Our customers have now made a move out of the country. Shouldn't we follow?" Ma said.

In his eyes, the financial crisis of 2008 provided a good chance for Chinese banks to speed up their globalization. The deleveraging process of banks in Europe and the US is helping Chinese banks to expand their businesses, acquire other financial institutions and attract talent at a lower cost.

"We have equivalently strong products and services. What we need to improve is our management. We need to adopt a more advanced concept of management to better push forward the globalization," Ma said.

Besides sustaining its development in the US market, CMB will set up a representative office in Taipei later this year and continue to seek a chance to upgrade its London office, opened last year, to a branch in the near future, Ma said.

|

||||

However, despite his ambitious plans overseas, the senior banker said the domestic market was still CMB's priority and the company was now under its second reform - to improve its risk-pricing ability and develop more small and medium-sized corporate customers.

Ma said he was optimistic about this year's profit prospects and added that the latest government policy to tighten home loans would "not impose much influence" on CMB "for the time being".