Money

ABC projects stable costs, higher revenues on eve of listing

By Te Kan (China Daily)

Updated: 2010-07-13 11:15

|

Large Medium Small |

|

|

|

Agricultural Bank of China is emphasizing its fee and commission-based income as the bank pushes further into intermediary services and away from the traditional lending business. [Photos provided to China Daily] |

Agricultural Bank of China (ABC) has the potential for bigger profits in the coming years, mainly from its brisk intermediary business, improving asset quality and better cost controls, said ABC's management in the road show.

The last of the country's big-four lenders to go public, ABC is also expected to benefit from its steadily growing scale and decreasing cost pressures.

With the most retail banking customers in the nation, ABC is set to register rapid growth in its fee and commission-based income as the bank further pushes into the intermediary services and away from the traditional lending business, the prospectus said.

Initially founded in 1951, ABC has set its sights on the custodian, cash management, third-party custody and other promising sectors to further diversify its revenue streams and gain profits from more than interest rate spreads.

The nation's second-largest bank in assets under custodianship, ABC is raising its profile in the sector by improving services and expanding products.

ABC, which has a complete product line in the custodian business, realized 761 million yuan income from the service in 2009.

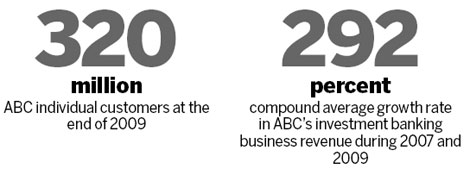

With 320 million individual customers by the end of 2009, ABC is also moving to expand its wealth management products and credit card business.

The Beijing-based lender signed up 51,000 customers at its cash management business division by the end of 2009, including 55 of China's top 100 companies and 35 percent of the country's top 500 firms.

The bank provided third-party custody services to 93 brokerages. The compound average annual growth rate of the third-party custody fees income reached 101.1 percent during 2007, 2008 and 2009.

The bank also provides financial advisory, M&A advisory and other investment banking services.

It is also involved in bond sale underwriting, bond investment advisory and consulting and asset-backed securitization business.

The compound average growth rate of ABC's investment banking business during 2007 and 2009 was a staggering 292.2 percent, leading the bank to be named "Best Innovative Investment Bank" and "Best Bond Underwriter" in 2008 and 2009 in the Security Times' annual competition.

ABC also has the most extensive network of outlets among the country's large commercial banks and may also benefit from the steadily growing and increasing quality of its assets, according to its prospectus.

ABC's outstanding loans and deposits amounted to 4.1 trillion yuan and 7.5 trillion yuan by the end of 2009, up 23 percent and 33.5 percent respectively.

Improved assets

The lender, the country's third biggest by assets, is planning to "constantly" improve its asset structure and asset management capacity to increase the returns on its expanding portfolios.

|

||||

Meanwhile, ABC's assets quality has been improving constantly since its historical non-performing assets were spun off in 2008.

Non-performing loans (NPL) dropped to 134.07 billion yuan in 2008 from 818.85 billion yuan in 2007, and further declined to 120.24 billion yuan by the end of 2009.

Its NPL ratio plummeted from the enormous 23.57 percent in 2007 to 2.91 percent by the end of 2009, and further dropped to 2.46 percent by the end of March, the bank said in the prospectus.

ABC's provision coverage ratio reached 105.37 percent by the end of 2009, and it further rose to 123.25 percent by the end of March, closer to the 150 percent required by the banking regulator, indicating that the bank will face less pressure in the future to raise the ratio.

It will reduce the amount of money the bank needs to set aside as provision in the future, which will propel the profits growth.

ABC said it has basically completed its IT infrastructure buildout so its main operating expenses in the next few years will largely be for office decorations in its outlets.

A considerable number of its more than 440,000 employees are located in the less-affluent county regions where general salary levels and living costs are lower, so it does not expect significant increases in salary costs over the next few years.