Economy

Shanghai to boost its M&A market

By Zhou Yan (China Daily)

Updated: 2010-11-26 09:18

|

Large Medium Small |

|

|

|

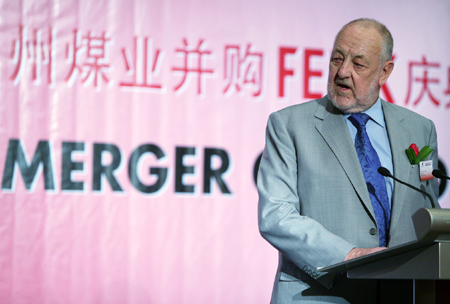

Travers Duncan, chairman of Felix Resources Ltd, attends the merger ceremony for Yanzhou Coal Mining Co's acquisition of Felix Resources Ltd in Sydney. Chinese companies are increasing their presence in the global merger and acquisition arena. [Photo / Bloomberg] |

SHANGHAI - The local government is making moves to enhance its mergers and acquisitions (M&As) market, a move in tune with Shanghai's ambition to make itself a global financial hub by 2020.

The city will initially actively propel the construction of its financial market and M&A-related auxiliary services, especially the agents who facilitate deals, to aid these activities, said Shanghai Vice-Mayor Tu Guangshao on Thursday.

He said the local government is also considering setting up a China Mergers and Acquisitions Association in Shanghai.

Meanwhile, plans to open an M&A museum are also in the pipeline to help create an M&A culture in the city.

"We've made concrete efforts to encourage benign conditions to allow these plans to materialize," Tu said.

The M&A market, in turn, will help catalyze improvements in the city's financial market functions, structures, and systems, as well as boosting badly needed adjustments to its economic structure. This will help Shanghai further speed up its plans to become a global financial center by 2020, an ambition which was approved by the State Council in March 2009.

According to figures from the Shanghai headquarters of the People's Bank of China (PBOC), there are 11 financial institutions running M&A loan businesses in the city, lending more than 10 billion yuan ($1.5 billion) during the first seven months of this year.

The central government in September issued guidelines on the promotion of enterprise M&A in six major industries, including automobiles and cement, to accelerate cross-border corporate restructuring and cater for the nation's aim of rebalancing the economy as the 12th Five-Year Plan (2011-2015) approaches.

"We should increase support for cross-border M&A activities, which is of great significance to China's economy and will help stimulate the Asian economic recovery," said Su Ning, board chairman of China UnionPay, the country's only credit card network.

The former vice-governor of the PBOC also urged more private firms, which have actively sought areas of overseas expansion, to participate in cross-border deals using their extensive capital resources.

Privately owned auto maker Zhejiang Geely Holding Group in August completed its $1.8 billion acquisition of a stake in Volvo Car Corporation, a move which emphasizes the desire of China's cash-rich private companies to make acquisitions abroad.

In addition, industry experts said that financial institutions should develop more financial innovations to supply China's overseas acquisition wave, and encourage more private equity funds to participate in cross-border deals, rather than simply focusing on pre-Initial Public Offering projects.